We are reiterating our “Buy” rating on Costco Wholesale (COST) and raising our 12-month target price to $630 from $610. In our view, Costco continues to stand out as a company with consistent growth and high relevance to value-conscious customers, explains Christopher Graja, analyst at Argus Research.

Historically, periods of stock-market turbulence have proven to be good times for careful and disciplined stock selection, with a focus on the highest-quality and financially strongest names. We put Costco on our Buy list in October 2008 at a price of $58.

We believe that Costco’s financial strength and ability to deliver exceptional value to consumers are key differentiators for the stock in the current market environment. The company’s membership base may also be more affluent than the national average, which could be beneficial.

Our analysis of core operations suggests that execution of the business plan remains excellent, with strong traffic and membership renewals. If investors are looking for clues to our future ratings or target changes, these two measures of member engagement are likely to be important indicators because they are drivers of earnings growth and earnings stability.

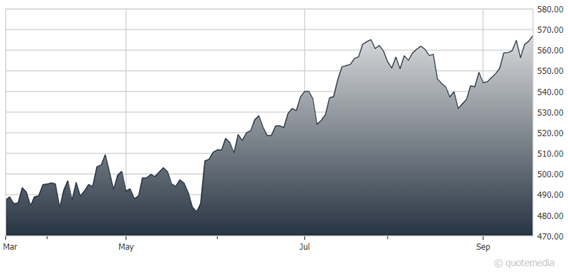

Costco Wholesale (COST)

While Amazon (AMZN) is a threat to every retailer, we continue to like Costco based on its low prices and efficient operations. Although Amazon offers the world’s biggest selection, Costco sells a smaller, curated selection of items that enables it to save money for customers, make a reasonable profit, and share some of the savings with suppliers, which further improves COST’s competitive position.

Costco also has greater pricing power on its narrower range of products as well as attractive private-label merchandise. In FY22, sales of the company’s private-label Kirkland merchandise rose approximately 100 basis points to 28% of sales. That would be approximately $62 billion on $222.7 billion of annual sales. That is more than revenue at Coca-Cola, more than three-times as much as Colgate-Palmolive, and even more than Kraft Heinz, Kellogg, and Campbell Soup combined.

Approximately two-thirds of the company’s FY20 operating income also came from membership fees. The percentage fell to 58% in FY21 and 54% in FY22, but that is a good problem to have. Membership fees grew a strong 9.5% in FY22, but operating income jumped 15%. This revenue stream adds stability to earnings, which stands out in the volatile retail sector.

Costco remains one of our favorite merchants, and we think the company has one of the best management teams in all of retail.

Recommended Action: Buy COST.