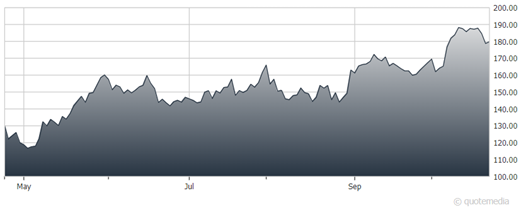

We are initiating coverage of cybersecurity provider CrowdStrike Holdings (CRWD) with a Buy rating and a target price of $220. While CRWD shares were hit hard in the 2022 market and tech sector selloffs, they have made an extraordinary rebound in 2023, outperforming both the cybersecurity industry and the broad market, writes Joseph Bonner, analyst of Argus Research.

We see CrowdStrike, with its focus on next-generation cybersecurity, as a strong competitor in the highly fragmented enterprise cybersecurity market. CrowdStrike offers a simple, integrated platform of cybersecurity tools for both larger enterprises and smaller SMB clients.

The company’s Falcon platform protects enterprise workloads and customer data across cloud-based environments to endpoints in the cloud, in the internet-of-things, and on mobile devices. In our view, CrowdStrike software is competitive with the best choices on the market.

CrowdStrike Holdings (CRWD)

The company also has a strong opportunity to expand its business to the nearly 50% of companies that have not yet upgraded from traditional antivirus software, and to take advantage of the secular growth in cloud workloads. Management sees opportunities to increase the company’s penetration of the government and international markets.

Like many enterprise tech companies, CrowdStrike has pivoted toward greater profitability in an uncertain macroeconomic environment. The company has been doubling non-GAAP profit and even reported two consecutive quarters of modest GAAP profitability in fiscal 1Q24 and 2Q24, helped by its focus on margin improvement. We view this strong operating expense leverage as a hallmark of good management.

CrowdStrike reported results for fiscal 2Q24 (ended July 31) after the close on August 30. The company beat the consensus revenue estimate by $7 million and the high end of management’s guidance range by $4 million. It also beat the consensus EPS forecast by $0.18 and the high end of its guidance range by $0.17. With the 2Q results, CrowdStrike raised its FY24 revenue and non-GAAP EPS guidance.

Like many enterprise tech companies in our coverage group, CrowdStrike is currently seeing more cautious behavior from customers — with increased scrutiny of deals resulting in longer deal cycles. Management sees an opportunity to push its cybersecurity platform consolidation/cost-savings theme in the current weak demand environment.

On September 19, CrowdStrike announced plans to acquire Bionic, a cloud workload observability application. Bionic provides visibility into cloud application behavior and vulnerability prioritization without disrupting the application development process. While terms of the deal were not announced, TechCrunch reported a price of $350 million in cash.

CrowdStrike did note that the deal included stock options subject to vesting conditions, which are typical for this type of transaction. CrowdStrike plans to offer the Bionic application both integrated with the Falcon cloud security platform and on a standalone basis. It expects to complete the acquisition in the current fiscal 3Q24 (ending October 2023).

Recommended Action: Buy CRWD.