A two-year interest rate trend is about to turn. When it flips, JPMorgan Chase & Co. (JPM) CEO Jamie Dimon’s safe, somewhat-secret, 7.4% dividend play will directly benefit. I’m talking about my favorite bond fund for 2024, the iShares JP Morgan USD Emerging Markets Bond ETF (EMB), explains Brett Owens, editor of Contrarian Income Report.

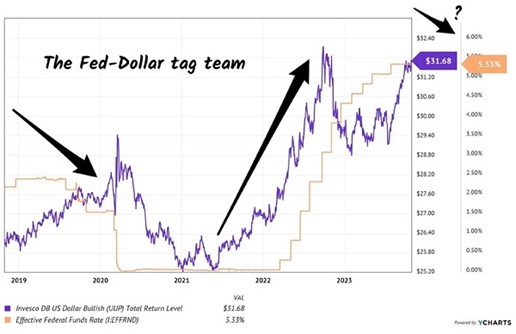

For two straight years, the US dollar has rallied relentlessly. Credit (or blame) the Federal Reserve. When the Fed hikes, the buck rallies.

But an inflection point is near. The Fed will pause in its interest-rate hikes soon. This means the greenback is near a top, give or take, because it moves along with its best friend, the Fed Funds Rate. Who leads who is an academic argument...or one to be settled over drinks! The bottom line is that when the Fed cuts, the dollar declines:

The Fed Funds Rate and Dollar Trend Together

A weak buck is a big catalyst for emerging bonds. Foreign countries and companies often borrow in US dollars rather than their own currency. But they still have to service the debt in their own currency, or buy dollars to do it, and a pricier buck makes that more difficult.

We have a friendlier setup brewing for 2024. We contrarians should position ourselves for a weaker dollar, which will “surprise everyone” who only reads the headlines. To do so, we turn to Dimon and EMB.

EMB has a headline 5.2% yield but that’s too low. The fund’s SEC Yield reveals the sweeter truth. “SEC Yield” reflects the interest the fund earned, minus expenses, over the past 30 days. It’s a fairer and more accurate calculation of what’s current and ahead than is the trailing twelve-month yield.

With the SEC calculation, we’re changing our focus from the rearview mirror to the road ahead. What’s EMB likely to pay over the next 12 months? Using SEC yield gives us a fat 7.4%. Now we’re talking.

With the greenback topping out, EMB will grind higher. Which means price gains on top of a 7.4% payout, paid monthly. Perfect!

Recommended Action: Buy EMB