Let the good times roll! A good market just got better. A petering rally has been reinvigorated. And the good times may continue to roll through January. This action is particularly good for previously downtrodden safe stocks, and I like ONEOK (OKE) here, says Tom Hutchinson, editor of Cabot Dividend Investor.

The peaking of interest rates started a market rally from the lows of late October. The Fed indicated it is done raising the federal funds rate. The notion that interest rates have peaked prevailed in the market and the benchmark 10-year Treasury yield plunged from about 5% to under 4%.

Inflation and rising interest rates hindered the market for the last two years. Under-control inflation and peak interest rates eliminate the greatest deterrent to rising stock prices. After that euphoria started to run out of gas, stocks got another shot in the arm recently when the Fed indicated that three rate cuts are likely next year.

The market has already been factoring in rate cuts, but I didn’t believe it. Sure, I thought the Fed would start cutting the federal funds rate if the economy tanks, but the Central Bank indicated that rate cuts were likely even with their “soft landing” projection.

The S&P 500 has rallied about 13% since the end of October and is now up 24% for 2023. Plus, the previously thin rally has broadened out to include many interest rate-sensitive stocks that had been beaten up all year.

We’ll see if the low inflation, falling interest rates, and soft landing scenario persists through 2024. Anything can happen. It’s possible that the rosy scenario discombobulates, or something else fouls things up. But for now, it looks like this rally will continue through this year and into next.

ONEOK (OKE)

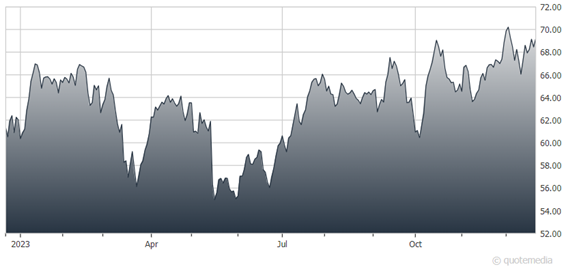

As for OKE, its performance has been solid yet bouncy these two past years. But in a very tough market for dividend stocks, it has done fine, especially considering the high yield of 5.6% it offers.

The stock was recently up more than 13% YTD. That’s a very solid performance for a safe dividend stock in the rising interest rate environment. ONEOK reported solid earnings with adjusted EBITDA growth of 11% over last year’s quarter as natural gas volumes were up 12%. The company also raised the guidance on projected consolidated earnings going forward.

Recommended Action: Buy OKE.