American Tower (AMT) is a Real Estate Investment Trust (REIT) that owns, operates, and develops an extensive portfolio of cell towers and other communications assets worldwide. It’s a mobile communications infrastructure powerhouse with over 220,000 cell towers in 25 countries on six different continents, as well as 28 data centers in the US, explains Tom Hutchinson, editor of Cabot Dividend Investor.

AMT is headquartered in Boston, has been in business more than 28 years, and has roughly $96 billion in market cap. Cell towers are fantastic assets to own. They are those weird-looking poles you see around with boxy antennas that send and receive signals to and from cell phones and other mobile devices.

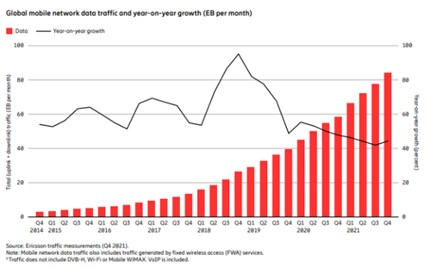

Telecom companies lease these towers out rather than go to the added expense of building or acquiring their own. And demand for mobile data continues to grow.

The more advanced 5G infrastructure and the Artificial Intelligence (AI) applications it enables are fueling traffic growth. According to research from telecom company Telefonaktiebolaget LM Ericsson (ERIC), average mobile data usage per smartphone is set to rise from 21 GB in 2023 to 56 GB in 2029. 5G’s share of mobile data traffic is forecast to grow by 76% in the next six years. And total mobile data traffic is estimated to grow by a factor of around 3X between 2023 and 2029.

As demand for mobile data grows, so will demand for wireless infrastructure and American Tower’s properties. AMT’s customers include mobile network operators, multinational telecommunications companies, media, and broadband providers.

The largest US customers are Verizon Communications (VZ), AT&T (T), and T-Mobile US (TMUS). These reliable customers are signed to long-term leases of five to ten years and the towers have exceptionally low churn rates. Revenues are highly dependable, and the business has automatic growth built in.

American Tower currently pays an annual dividend of $6.80 per share, which translates to a 3.2% yield at the recent stock price. Reliable revenues have enabled the company to increase the payout every year for the last 12 years. In the past five years, the dividend has been raised 19 times at an average annual growth rate of 15.4%.

Recommended Action: Buy AMT.