Stock traders and capital gains-focused investors have their fingers crossed and capital bet on the Federal Reserve starting to cut interest rates soon. Based on recent inflation and employment data, I think it’s very possible that the Fed will not be that quick to cut rates. Because of that, I think there’s one specific asset class you should be buying right now, and one stock in it: Blue Owl Capital Corp. (OBDC), advises Tim Plaehn, editor of The Dividend Hunter.

I am in the higher-for-longer camp and believe investing in companies that benefit from higher rates will continue to pay big dividends. Variable-rate loans have performed very well over the last two years, and if interest rates stay high or drop very slowly, this will continue to be an asset class to own.

By law, Business Development Companies (BDCs) make debt and equity investments in small- to medium-sized corporations. BDCs operate under special rules that require them to pay out 90% of net interest income as dividends.

Most BDCs have loan portfolios that consist of senior loans with variable interest rates. The rate increases by the Fed over the last two years have been very good for the BDC sector. The better-run companies in the group have rewarded shareholders with growing regular dividends plus supplemental dividend payments.

Blue Owl Capital Corp. (OBDC)

I include four BDCs in my Dividend Hunter recommended portfolio. They have reported excellent 2023 fourth-quarter results. Here are some highlights taken directly from the OBDC earnings report:

- Fourth quarter net investment income (NII) per share of $0.51, which represents the fourth consecutive quarter of record NII for the company.

- As a result, the Board declared a fourth-quarter supplemental dividend of $0.08 per share.

- Total dividends for the fourth quarter were $0.43 per share, which represents an approximately 11% annualized yield based on fourth-quarter net asset value (NAV) per share.

- Total dividends of $1.59 per share paid to shareholders in 2023, an increase of approximately 25% from the prior year.

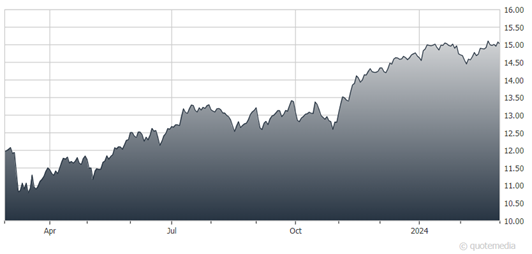

- Delivered a total return of greater than 40% for 2023.

- For the first quarter of 2024, increased the quarterly dividend by $0.02 to $0.37 per share, marking the third dividend increase since the fourth quarter of 2022.

- NAV per share increased to $15.45 compared to $15.40 as of September 30, 2023.

On the regular dividend rate, Blue Owl recently yielded just under 10%. During the fourth quarter, the Fed did not raise interest rates and the company still posted record results. As the Fed keeps interest rates up at current levels, BDCs like Blue Owl will continue to pay attractive dividends and supplemental dividends when they do exceptionally well during a quarter.

Recommended Action: Buy OBDC.