The EVP of the Kite subsidiary at Gilead Sciences Inc. (GILD) recently presented at the Leerink Partners Global Biopharma Conference. She said the CAR-T industry only has a 15% to 17% share of treatments. A 15% class share for a curative medicine is not acceptable, notes Michael Murphy, editor of New World Investor.

Kite has 142 authorized treatment centers (ATCs) today in the US, primarily in academic centers and large hospitals, where CAR-T is being used, although not fully. But only 20% of patients are seen in academic centers. Some 80% of patients are seen in the community today, and only 30% of them are getting referred into the ATCs. So 50% are not getting the opportunity of CAR-T, and that’s where the major growth opportunity is.

Last year, Kite served 6,000 CAR-T patients and still had capacity for more. By 2026, they’ll be able to treat 24,000 a year. That drives down cost of goods and increases profitability.

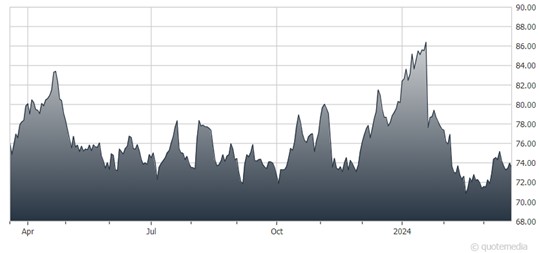

Gilead Sciences Inc. (GILD)

Meanwhile, the CFO spoke at Barclays Global Healthcare Conference. He said Gilead is moving into the second stage of the restructuring expansion of the company. The firm has a number of growth opportunities and expects accelerating growth through the end of the decade.

In other news, the Hart-Scott-Rodino waiting period for their CymaBay Therapeutics Inc. (CBAY) tender offer has expired, so GILD will close that deal. The company also just signed a partnership with Merus, a Netherlands-based biotech company, for a potential $1.5 billion deal for the development of T-cell engagers.

Merus will receive an upfront payment of $56 million for initial targets and an equity investment of $25 million from Gilead. The deal also includes the possibility of Merus earning additional payments based on the achievement of development and commercialization milestones.

The collaboration will utilize Merus’ proprietary platform, which is capable of designing antibodies that can bind to three targets simultaneously. It further expands Gilead’s oncology portfolio.

Recommended Action: Buy GILD.