Ulta Beauty Inc. (ULTA) reported pretty fourth quarter results with sales increasing 10% to $3.55 billion, net income jumping 16% to $394.4 million, and EPS up 21% to $8.08. Comparable store sales increased 2.5%, driven by a 4.5% increase in transactions and a 1.9% decrease in average ticket, highlights Ingrid Hendershot, editor of Hendershot Investments.

For the full fiscal year, revenues rose 10% to $11.2 billion with net income increasing 4% to $1.29 billion and EPS up 8% to $26.03. Return on shareholders’ equity was a gorgeous and profitable 56.6%.

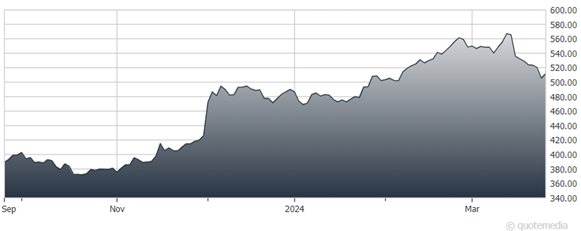

Free cash flow declined 11% to $1 billion with the company repurchasing 2.2 million of its shares during the year for $1 billion at an average cost of about $454.54 per share. The company’s board of directors approved a new share repurchase authorization of $2 billion.

Ulta Beauty Inc. (ULTA)

Since 2014, Ulta Beauty has returned $5.8 billion to shareholders through its share repurchase program, while continuing to make strategic growth investments. Ulta Beauty announced the formation of a joint venture with Axo, a highly experienced operator of global brands, to launch and operate Ulta Beauty in Mexico in 2025.

International expansion represents an incremental, long-term opportunity for Ulta to extend their reach and leverage their differentiated value proposition. The company’s outlook for fiscal 2024 is for net sales between $11.7 billion to $11.8 billion, representing 4% to 5% growth, driven by 4%-to-5% comparable store sales growth and the opening of 60-65 new stores.

The company’s operating margin is expected in the range of 14% to 14.3%, leading to EPS of $26.20 to $27, representing 1% to 4% growth. Capital expenditures are expected in the range of $415 million to $490 million.

Recommended Action: Buy ULTA.