When the market is being tested, it helps when the right companies put up good numbers – not just to support their own stocks, but to also reassure investors that it will take something very big to disrupt the primary uptrend for the stock market. One of my recommended stocks is Verizon Communications Inc. (VZ), notes Bryan Perry, editor of Cash Machine.

Be it sticky inflation, a rise in bond yields, geopolitical tensions, a trade war with China or stressful election politics, as long as the greater US economy can support healthy consumer and business conditions, a bullish bias will maintain the upper hand in the overall narrative.

Stable housing, manufacturing, retail sales, exports, and labor markets will prevail over all the other concerns that, while important, are not as vital to Wall Street’s sensitivities as top- and bottom-line results.

Our model portfolio is about fully invested. But the month of April was a sort of litmus test for investors because they had to endure more volatility due to implied higher-for-longer rate policy by the Fed and signs that the lower trend in inflation has paused.

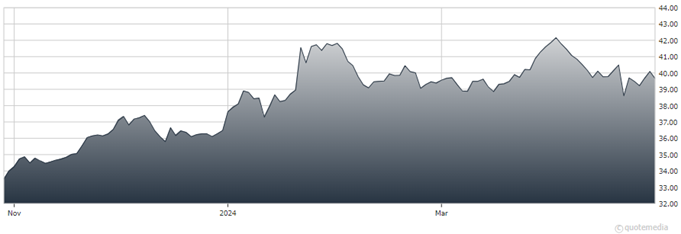

Verizon Communications Inc. (VZ)

For our purposes, the investing landscape is beneficial to most of our holdings. We have a resilient economy that is a net positive for high-yield bond balance sheets, a backdrop of incrementally higher bond yields that rewards floating rate assets, and a strong demand curve for energy transportation and shipping.

As is most always the case, the quarterly earnings numbers will be by trumped by what the companies state about their near-term and yearly outlooks. It is during these reporting periods throughout the year that our portfolios are graded by market forces, and I’m looking for our model portfolio to score very high.

Leading off for us is VZ, which posted earnings of $1.15 per share, topping estimates by $0.03 on revenue of $3.3 billion that missed by $230 million. Total wireless service revenue was $19.5 billion, a 3.3% increase year over year.

Total broadband additions were 389,000, including 53,000 Fios Internet net additions. Verizon Business reported 151,000 fixed wireless additions, its best quarter to date, with fixed wireless revenue for Q1 at $452 million, up $197 million compared to the prior year.

Recommended Action: Buy VZ.