I get a lot of questions from super-sharp 5 Fitzers and members of the OBA Family about energy companies that’ll be needed to power AI. All that data takes a lot of juice. It’ll take more. So, should you buy Dominion Energy Inc. (D), asks Keith Fitz-Gerald, editor of 5 With Fitz?

Goldman Sachs sees data center power demand growing by 160% into 2030. But I think it’ll be more like 200% or more within the next few years.

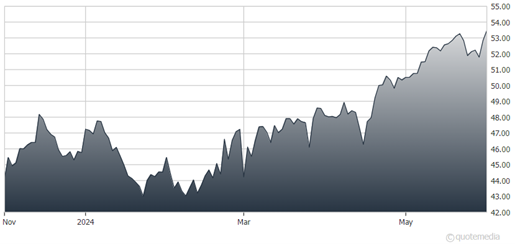

Dominion Energy Inc. (D)

If I had to pick, I’d take a hard look at Dominion because it’s got a lock on Virginia, which is currently home to 35%-40% of global hyperscale data center capacity, including facilities belonging to the biggies (Azure, AWS, and GCS).

The stock is down double digits from its high. But it pays a yield of nearly 5%. That is appealing as heck to dividend-hungry investors.

That said, my fav has roughly the same shareholder yield, but the dividend growth is considerably higher, stronger, and more consistent. Dominion could ride the AI hype wave, but then what? I want the stocks I buy to be there when I need ‘em.

You?