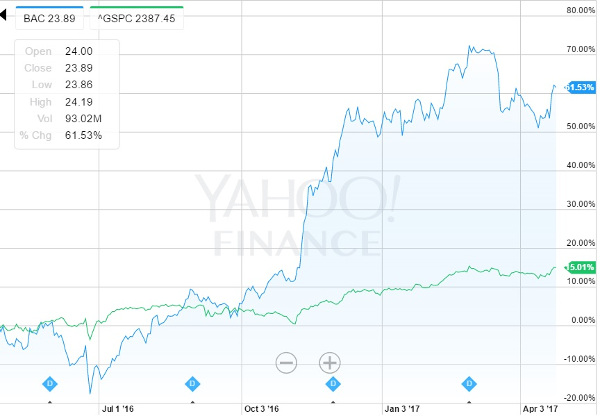

With the U.S. stock market regaining its momentum over the past week, a surprising number of Alpha Algorithm strategies increased their bets on the financial sector, explains Nicholas Vardy, editor Vardy's Alpha Algorithm, a data-driven wealth system.

Our latest recommendation highlights that trend, as well. Founded in 1874 and based in Charlotte, North Carolina, Bank of America Corporation (BAC) is one of the world's leading financial services companies.

It operates through four segments: Consumer Banking, Global Wealth & Investment Management, Global Banking and Global Markets.

It provides its products and services to consumers through approximately 4,600 financial centers, 15,900 ATMs, call centers and online and mobile platforms.

Here's a review of 11 top investment strategies that are currently betting on Bank of America:

- Value Tilt

Selected using a multi-factor modeling approach, the company is a value stock designed to enhance portfolio risk/return characteristics.

- Hedge Fund Alpha

Based on publicly available disclosures, successful hedge fund managers are investing in the stock.

- Billionaire Bet

The stock is one of 30 U.S. companies tracked in an equal-weighted index selected from the portfolios of 10 asset managers with a personal net worth of at least $1 billion.

- Goldman Sachs Hedge Fund Index

The stock is part of the Goldman Sachs Hedge Industry Index, which tracks an equal-weighted index of the 50 most frequently held U.S. companies selected from the portfolios of hedge funds.

- Goldman Sachs’ Active Beta

The stock is selected according to four factors -- value, quality, momentum and low volatility. These, in turn, are based on criteria including book value, sales and cash flow scaled by share price, profit/assets or return on equity (ROE), risk-adjusted returns and daily standard deviation of returns.

- Fundamental Strength

A top U.S. stock based on fundamentals measured by book value, cash flow and sales dividends.

- Large-Cap Momentum

The stock is part of a major hedge fund’s systematic strategy that invests in large- and mid-cap U.S. companies with positive momentum and that rank in the top third of total return over the prior 12 months, excluding the last month.

- Hedge Fund Gurus

The stock is one of the top U.S.-listed equity positions reported on Form 13F by select hedge funds with concentrated top holdings.

- Shareholder Yield

It is one of the companies (a) paying cash dividends, (b) engaging in net share repurchases and (c) paying down balance-sheet debt.

- Insider Sentiment

One of 100 equally weighted U.S.-listed large- and mid-cap stocks chosen based on trading in company stock by corporate insiders, price momentum and trailing 12-month volatility. Specifically, it looks at the increase in insider holdings.

- Large-Cap Alpha Growth

The company has been chosen as part of an alpha-seeking index that selects and weights growth stocks from the S&P 500 Growth Index. The proprietary methodology uses price appreciation -- among more traditional factors -- and weights the constituents based on their respective growth scores.

Our recommendation is to buy Bank of America at market price and place your stop at $22.00.