It was a quiet day in the stock market yesterday and it looks like a quiet day in the stock market so far today, too. Gold and silver continue to gain, though, and crude oil is bouncing back. Treasuries and the dollar are modestly lower.

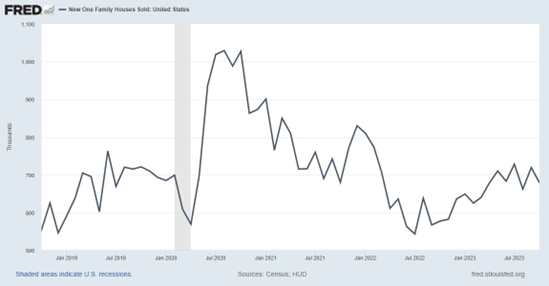

We got the first round of housing data for the week yesterday and it reflected the impact of higher mortgage rates. New home sales sank 5.6% between September and October to a seasonally adjusted annual rate of 679,000 units. That missed the average forecast of 723,000 – and is well off the pace recorded in 2020-2021 as you can see in this chart.

New Home Sales

Still, sales were up almost 18% year-over-year. Mortgage rates dropped sharply in the last few weeks. And ironically, the 17.6% drop in median new home prices we saw last month should help make for a healthier market by increasing affordability.

A separate report this morning from S&P/Case-Shiller showed prices up 3.9% year-over-year. That’s well below the 20%-plus appreciation rates we were seeing in 2022. But it’s a tick up from the negative YOY numbers we were seeing back in the spring and summer of this year.

Meanwhile, the “Revenge of Value Investing” theme hasn’t exactly played out as hoped in 2023. After outperforming growth stocks last year, value names have fallen behind once again. In fact, the Russell 3000 Value Index is underperforming the Russell 3000 Growth Index by 31 percentage points – the second-widest margin this century. Investors can’t get enough of technology stocks in general, and AI-driven stocks in particular.

Finally, Tesla (TSLA) is scheduled to start the first deliveries of its futuristic-looking “Cybertruck” on Nov. 30. The problem? Manufacturing the bullet-and-arrow-proof, stainless steel vehicle body is apparently a real chore. For that and other reasons, it’s going to take a LONG time to reach the annualized production target of 250,000 trucks. But at least a handful of truck owners will be safer in the meantime should a zombie apocalypse strike.