The market’s leaders – “Big Tech” stocks -- are cratering today on Artificial Intelligence-related news out of China. Nasdaq 100 futures plunged more than 4% in the early going, with US and European tech names combined on track to lose $1.2 TRILLION in market capitalization. Treasuries are rallying on safe-haven buying, while the dollar and Bitcoin are weaker. Gold, silver, and crude oil are all modestly lower.

The Chinese technology firm DeepSeek released more details on its AI model/chatbot system, saying it spent just $6 million on computing and technology services to build it. That’s a small fraction of the $100 million or more that leading US firms are spending on theirs. More specifically, it only needed help from around 2,000 Nvidia Corp. (NVDA) chips, versus the 16,000 or so that top US AI players use.

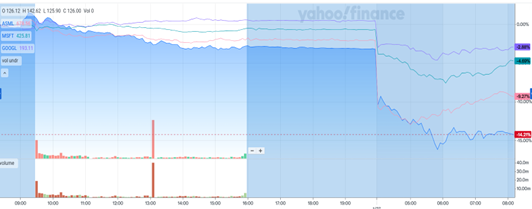

NVDA, ASML, MSFT, GOOGL (2-Day % Change)

Despite its bargain-basement cost, the model reportedly performs almost as well as high-cost competitors from companies like OpenAI and Meta Platforms Inc. (META). DeepSeek was launched in 2023 by Liang Wenfeng, head of a quantitative hedge fund firm that uses AI to drive trading decisions.

Should its product continue to wow users and tech sector executives, it could undermine the case for spending hundreds of billions of dollars on high-end tech gear, infrastructure, and engineering talent. That’s why US tech stocks, which have led the market’s advance, are cratering. NVDA dropped more than 11% in early trading, while ASML Holding NV (ASML) slid 7%.

Meanwhile, in the steel industry, an activist money management firm is trying to derail Nippon Steel Corp.’s (NPSCY) proposed takeover of US Steel. Already facing opposition from the US government, the $15 billion deal is being challenged by Ancora.

The firm alleges CEO David Burritt and other US Steel board members are only pushing it because they’ll get $100 million in compensation if it closes. It would rather US Steel pursue the deal’s $565 million breakup fee and focus on restructuring its operations or selling to someone else. For now, US Steel and Nippon Steel are challenging the former Biden Administration’s deal ban in federal court.