The natural gas market has fallen by more than 50% in the last eight months, reports Andy Waldock.

There are very few new markets of interest this week. The upside is that our analysis spent managing several currently profitable positions we’ve recently discussed. We’ll begin with a new setup in the natural gas market then, and we’ll evaluate some of our current holdings.

Natural Gas

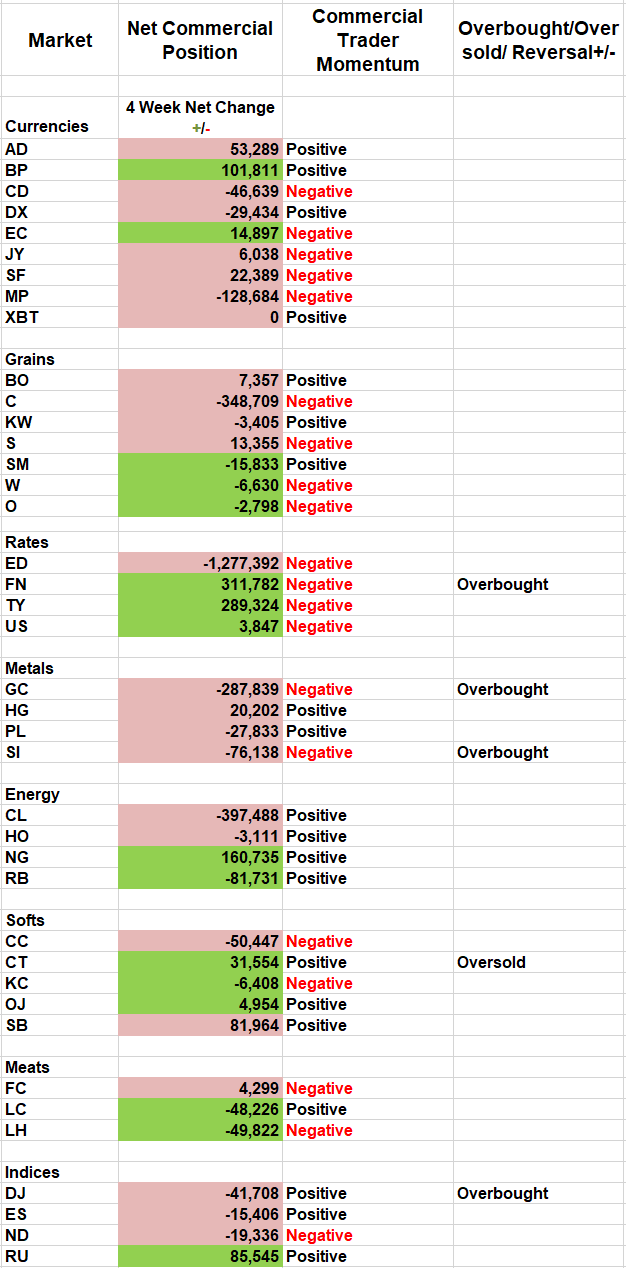

The natural gas market has fallen by more than 50% in the last eight months. Throughout this decline, the commercial traders remained patiently on the sideline, until recently. Natural gas below $2.50 has gotten the buy side’s attention. The commercial traders in natural gas have just set their second net position 52-week high in the last four weeks. Furthermore, the surge in buying has pushed the commercial traders’ collective net long position to its highest level since March 2016.

The commercial traders’ bullishness represents a tradeoff between low prices and potentially volatile August prices. Natural gas demand can surge when electricity demand rises with unexpectedly high summer temperatures. Natural gas prices are also affected by supply concerns as we begin the hurricane season. Commercial traders’ collective analysis is telling us that natural gas is currently, “cheap.”

We’ll side with the commercial traders and look for a buying opportunity. We expect this to come soon in the Daily COT Signals. Friday’s downward slide, in conjunction with the current COT report, has just set the trigger for our setup (see chart).

Open Positions from Previous Reports

Canadian Dollar

The commercial traders continue to sell the Canadian dollar heavily. Commercial traders reached their most bearish net position of the last 52 weeks, adding 10% more contracts to their short position. These actions collectively count as selling pressure. Lower the protective stop to last week’s high, $.7677. Look for at least, $.7500 as the nearest profit objective.

Cocoa: Commercial traders tipped their hand last week with another wave of selling. Technically, last week’s outside bar coupled to a close below the previous week’s low is very bearish, as well. Lower the protective buy stop to $2,538 per ton. Long-term moving average and technical support come in around $2,305.

Copper: The copper market isn’t getting the pop we expected. This trade very near even and should be offset.

Gold: Commercial traders increased their bearish position to another new 52-week high. Their selling was once again what we consider, “anxious.” We measure this by comparing last week’s action to their average net position movement. We’re currently seeing the same behavior we saw at the 2016 high. Leave the protective buy stop at the current top of $ 1,454.4. We’ll continue to update, accordingly.

Here is what Andy had to say about seasonality and the COT Report at the recent TradersEXPO New York.

Visit Andy Waldock Trading to learn more. Register and see our daily and weekly signals archive for entries and stop loss levels sent to our subscribers.