Earnings season has wound down with a raft of announcements from the beleaguered retail sector, and the latest numbers didn’t exactly improve matters for retail stocks, observes Chloe Lutts Jensen, income expert and editor of Cabot Dividend Investor.

Get Top Pros' Top Picks, MoneyShow’s free investing newsletter »

Most of the big department stores beat estimates, but their stocks dropped like rocks anyway. While a broad market selloff certainly contributed, investors were also disappointed by the chains’ relentlessly falling same-store sales.

I was actually surprised when I found out which stock performed best on my scans. Sure, I’ve been to their stores several times in the past year, but can they really be doing that much better than their brick-and-mortar retail peers?

Turns out they can! My top retail stock today is TJX Companies (TJX), the parent company of T.J. Maxx, HomeGoods and Marshalls.

The company currently has 3,800 stores in nine countries. TJX’s “off-price” formula is one of the few retail concepts that still seems to be able to lure shoppers into stores.

Merchandise is refreshed daily, and prices are usually 20% to 60% lower than at regular stores. Management describes their shopping experience as a “treasure hunt.”

I do visit my local T.J. Maxx pretty often, but I was still skeptical that the concept is Amazon-proof. But the numbers tell the story!

TJX’s revenues and EPS have grown steadily in each of the last five years. Same-store sales rose 3% last quarter, thanks to higher traffic. And analysts predict continued growth in both revenues and earnings going forward.

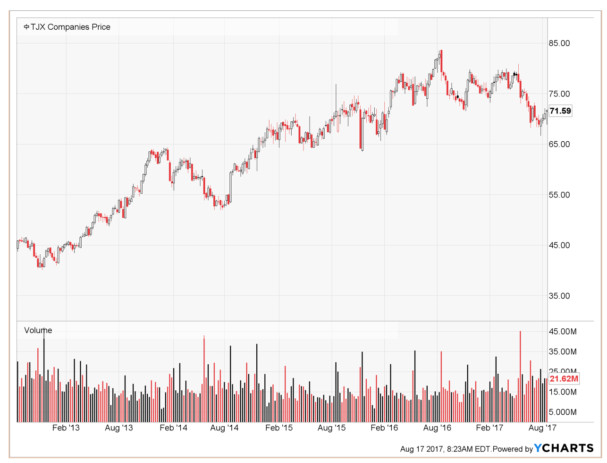

TJX doesn’t look bad technically either. Sure, the stock peaked a year ago, but the 13% pullback since then is still within normal correction territory, and is largely due to the larger retail selloff. (The Retail SPDR, XRT, has pulled back 14% over the same time period.) On a weekly chart, the correction looks pretty normal.

And management just raised their full-year guidance, which can be a good catalyst for gains in the stock.

Plus, TJX has a 20-year history of dividend growth, having increased their dividend every year since 1997. Today, TJX has a 1.8% yield, and a very reasonable 32% payout ratio.

In other words, the retail selloff has created a great opportunity for investors who like “treasure hunting” to pick up this good quality retail stock at a bargain price.

Subscribe to Chloe Lutts Jensen's Cabot Dividend Investor here…