Aqua America (WTR) has always been one of my favorite positions for long term investors who buy via dividend reinvestment plans, explains income expert Jimmy Mengel, editor The Crow's Nest.

Utilities by and large are profitable in good times and in bad. Even in a recession, people will pay their water bills before buying pretty much anything else.

Add to that the regulated nature of utilities, where the government basically lets them act as monopolies, and you have a steady place to generate income rather safely. Simply put, you must have some utility exposure in your portfolio.

Water is a great place to start. The U.S. uses 346,000 million gallons of fresh water every day. Each person uses a whopping 80 to 100 gallons of water per day, mostly through the use of toilets.

Because Aqua America provides water and wastewater services in the U.S., we think that it makes a great addition to a long-term diversified portfolio.

Aqua America is a publicly traded water and wastewater service provider in the U.S. It’s also constantly growing, with over 300 acquisitions over two decades.

qua America operates more than 1,400 public water systems and 187 wastewater treatment plants and collection systems. Together, these systems serve nearly 3 million people across eight states.

Aqua America has been paying consecutive quarterly cash dividends for 72 years and has increased the dividend 26 times within the last 25 years. It currently yields 2.27%.

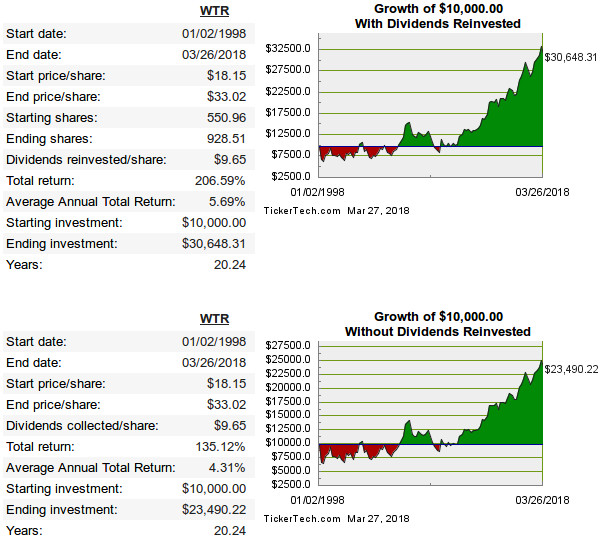

If you invested $10,00 in Aqua America 20 years ago, this is what you’d be looking at today:

Aqua America has a DRIP that offers investors a convenient and economical way to purchase shares of the company’s common stock. The plan also allows participants to reinvest the cash dividends in additional shares of common stock at a 5% discount.