Month after month we talk about what’s happening on the economic front and how it’s going to affect the markets. But one thing is clear: Uncertainty surrounds us and one asset class remains the most attractive, explain Mary Anne and Pamela Aden, editors of The Aden Forecast.

You’ll recall that last time we wrote you, the stock market was mixed. It had been moving up, but bearish pressures persisted. This month, however, the stock market tipped back to the bear market side.

The main culprit was rising interest rates. They’ve been keeping downward pressure on stocks. But when Fed head Jay Powell said interest rates may need to go higher than expected to fight inflation, it pushed stocks down even lower.

The stock market can’t stand rising interest rates. It’s one of the market’s worst enemies. High rates hurt the economy and corporate earnings, and it looks like earnings are going to stay low in the months ahead.

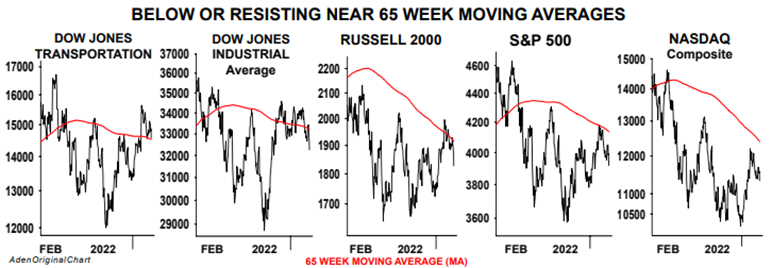

Our technical indicators are also currently bearish, with almost all the major stock indices below their 65-week moving averages. The only exception is the Transports, but we think that index will soon be joining the others on its downward path. And as long as they stay bearish below their moving averages, prices are going to fall further, eventually hitting new bear market lows.

Finally, our leading indicators are either all turning down or looking weak, reinforcing this bearish outlook. As long as bearish forces are gaining steam worldwide, we continue to feel that it’s best to stay on the sidelines and avoid traditional stocks for the time being.

What about other asset classes? We continue to avoid traditional bonds until the markets tell us it’s time to do otherwise. It’s amazing that interest rates have already risen 165% from their record lows in 2021 to where they are now. But even so, it hasn’t been enough. Real interest rates are still negative.

As for currencies, keep your cash funds in U.S. dollars. The dollar is poised to head higher and investing your funds in 90-day T-Bills would be a good option. You’ll get around 5% on them, which is a nice bonus and something we haven’t seen in a long time.

Finally, gold has held above its 23-month average. It’s also now jumping up and looking good. Silver has been weaker than gold, but it’s still poised to rise. Gold shares as well. These remain our favorite places to invest.

Recommended Action: We favor a portfolio mix of 47% cash, 53% gold and silver, gold shares, energy, and natural resources.