I recommend you buy Qualys (QLYS), a cloud-based cybersecurity firm. It delivers IT, cybersecurity, and compliance through the cloud to clients using a number of different apps, advises Sean Brodrick, editor of Supercycle Investor.

Qualys offers cloud security subscriptions to over 10,000 customers worldwide, including more than half of the Fortune Global 500 companies. It’s leveraging AI, too. It has a market cap of $7 billion and a Weiss Rating of B.

Wall Street spends a lot of time worrying about a potential recession. Thanks to that fear, companies cut back on hiring and other spending. However, cybersecurity remains strong, though growing at a steadier rather than a quicker pace.

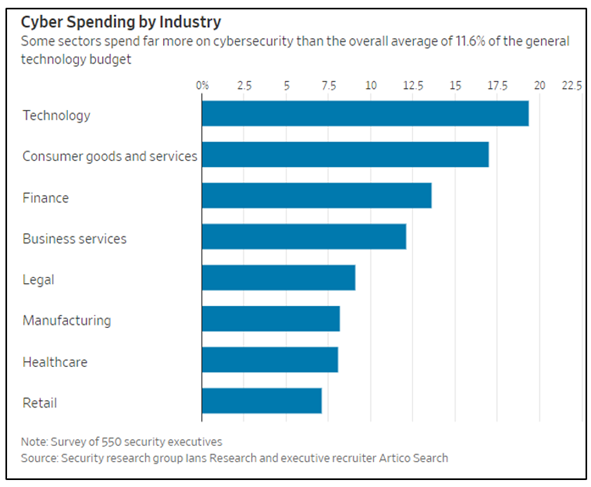

The average cybersecurity budget grew 6% in 2023, according to a recent study. That’s down from the double-digit increase we saw last year, but still up. And some industries spend a lot more.

Technology companies spend 19.4% of their budgets on cybersecurity, while consumer goods and services companies spend 17%.

And there is plenty of evidence that spending on cybersecurity will accelerate across the board. General spending on cybersecurity will increase to $215 billion next year, according to projections from consulting firm Gartner. That would be up 14.3% from $188 billion this year.

Qualys’ most popular offering is its Vulnerability Management, Detection, and Response (VMDR) cloud app. In simple terms, the VMDR app provides diagnostics for a company’s IT assets. It lets companies inventory their IT assets, hardware and software, allowing them to classify what’s crucial. Qualys continuously monitors these crucial assets for vulnerabilities, fixing exploitable issues while tackling cyberthreats.

Qualys makes money through subscriptions, which gives it predictable revenue. The company has a net profit margin just under 23%, the highest in its group. And its free cash flow margin is 35%.

The company has total debt of $32 million and cash of $208.7 million. So, it could pay off its debt if it wanted to. But it’s probably earning more interest on that cash than the interest it pays on its debt, so there’s no hurry on that.

In November 2023, Qualys reported Q3 earnings of $1.51 per share – much better than estimates of $1.13 per share. At the same time, revenue of $142 million also beat forecasts. Earnings are projected to rise 23% this year.