T-Mobile US (TMUS) provides wireless communication services through various service plan options. It also offers a selection of wireless devices, including smartphones, tablets, and other mobile communication devices. Our Strong Buy recommendation reflects our expectation that TMUS will continue to outgrow peers, explains Keith Snyder, analyst at CFRA Research.

We expect competitive pressures to remain fierce, but positively view free cash flow growth potential and churn. TMUS’s 5G network is at least 12 months ahead of both Verizon (VZ) and AT&T (T) which, combined with its aggressive plan pricing, has enabled the company to capture market share, while competitors struggle to keep up, often resorting to promotional activity to win customers.

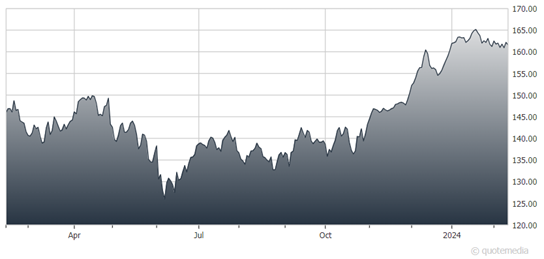

T-Mobile US (TMUS)

TMUS continues to raise its merger synergy guidance and now expects synergies of $7.3 billion to $7.5 billion, well ahead of the $3.8 billion delivered in 2021. It also expects total synergies to be more than $70 billion, up more than 60% from the original merger guidance of $43 billion.

Our 12-month target of $185 applies an EV/EBITDA multiple of 10.4x to our 2024 estimate, above peers, reflecting our view that TMUS will continue to capture market share without sacrificing profitability. Risks to our recommendation and target price include weaker-than-expected customer growth, higher-than-expected churn and debt issuance, and increased or prolonged pricing pressure.

Recommended Action: Buy TMUS.