As a value investor always on the hunt for profitable businesses trading at bargain prices, Ryanair Holdings Plc (RYAAY) has caught my attention. This Irish-based budget airline has built what legendary investor Warren Buffett might call a wide and sustainable moat in the European aviation market, notes Tim Melvin, editor of the Melvin Real Income Report.

First, consider the scale of operations. Ryanair isn't just another airline - it's Europe's dominant low-cost carrier, moving over 200 million passengers annually across 37 countries. With 95 bases and operations in 234 airports, they've built a network that would be nearly impossible for competitors to replicate. This reminds me of how Southwest Airlines originally dominated regional routes in the United States.

Second, the financial strength here is remarkable, particularly in an industry known for destroying capital. Ryanair maintains what I'd call a fortress balance sheet with $3.6 billion in cash and securities. Even more impressive, they've paid down nearly all the debt on their Boeing 737 fleet as of September 2024.

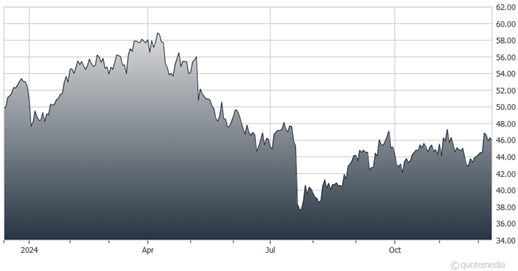

Ryanair Holdings Plc (RYAAY)

The company generates substantial free cash flow, which management deploys with admirable discipline. Rather than chasing growth at any cost (a common pitfall in aviation), they've focused on strengthening the balance sheet while returning capital to shareholders through dividends and buybacks. They've just completed a $700 million share repurchase and expect to announce another $800 million buyback within six months.

Third, looking at growth prospects, Ryanair has set an ambitious but achievable target of 300 million annual passengers by 2034. Their latest results show they're making steady progress, with passenger numbers up 9% to 115.3 million. While revenue grew only 1% due to fare competition (average fares dropped 10%), they maintained an industry-leading load factor of 95%.

The market appears to be missing something here. Despite Ryanair's dominant market position, rock-solid balance sheet, and clear growth trajectory, the shares trade at what I consider bargain levels relative to both cash flows and profits. Analysts project earnings growth of 11.8% annually and revenue growth of 7.7%.

Adding to the investment case, Ryanair has positioned itself as a leader in aviation sustainability, making significant investments in sustainable aviation fuels and carbon reduction technologies. This forward-thinking approach should help protect their market position as environmental regulations tighten in Europe.

Value investing legend Benjamin Graham taught us to look for companies with strong competitive positions, solid financials, and shares trading below intrinsic value. Ryanair checks all these boxes.