In 2020, Dutch Bros Inc. (BROS) was a little-known drive-through coffee chain with 370 locations. Today, it is the fastest-growing coffee chain in the US, with 950 locations in 18 states as of the end of the third quarter of 2024. It has an ambitious goal of expanding to 4,000 locations within the next 10 to 15 years, says Chris Preston, chief analyst at Cabot Stock of the Week.

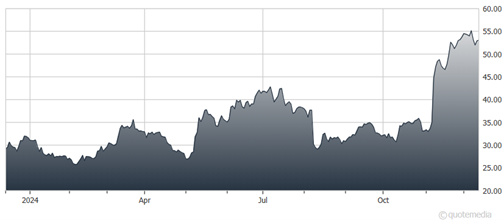

Given that the company has more than doubled its footprint in the last four years and that sales have more than tripled (from $327 million in 2020 to an estimated $1.26 billion in 2024) in just four years, it’s not an unrealistic plan. Meanwhile, BROS shares are up a mere 65% since the stock came public a little over three years ago, in September 2021.

Dutch Bros Inc. (BROS)

Virtually all of that growth occurred in late 2024 when the company reported stellar third-quarter results. Sales improved 28% year-over-year and it opened 38 new stores. Adjusted EPS also improved eight-fold from the third quarter a year ago, from 2 cents to 16 cents, while adjusted EBITDA grew 20%.

Its new mobile order rollout contributed to a 5% uptick in frequency among existing customers. Plus, its Dutch Rewards program saw over 1 million new registrants in Q3, accounting for two-thirds of all transactions. That shows Bros (not “Brothers”) loyalty is growing, as customers like the appeal of its drive-through-only business model, which differs from many Starbucks Corp. (SBUX) locations, where customers have to park and walk in.

For an on-the-go America in which unemployment is around 4%, Dutch Bros offers convenience for the legions of work commuters and others (including remote workers like myself who need the occasional outing). It doesn’t offer food yet, but it does sell smoothies and other cold drinks.

Bottom line: Americans are waking up to Dutch Bros’ existence, and so is Wall Street. I think the 60% return in late 2024 should carry over well into 2025, as the share price plays catch-up with the sales growth and footprint expansion.