Ally Financial Inc. (ALLY) is the leading all-digital banking company in the US, with 3.3 million customers and over $100 billion in loans. The primary revenue source is automotive loans (over 70%), but it is also diversified in auto insurance, commercial lending, mortgage financing, and credit cards, notes Tom Hutchinson, editor of Cabot Income Advisor.

The company was the financial segment of General Motors Co. (GM), where it developed a 100-years-old, fully developed auto loan business. It was spun off in 2009 during the financial crisis as part of GM’s bankruptcy reorganization. The company has since focused on the online business.

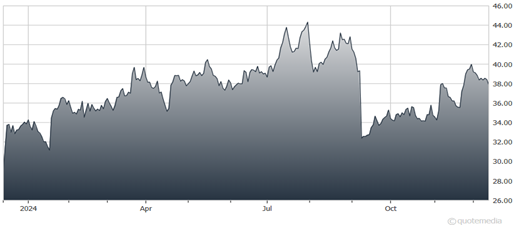

Ally Financial Inc. (ALLY)

Ally can attract a large deposit base online because it offers higher rates than traditional banks. It can do this because it is unburdened by the costs associated with physical branches and staffing. The bank has been able to add retail deposit customers for 62 consecutive quarters, including 57,000 in the third quarter of 2024.

Ally uses these deposits to make auto and other loans and has grown the business through online banking. That business is accelerating, and revenues have roughly doubled since 2017 from $5.8 billion to a trailing 12-month total of $11.5 billion.

A big reason to buy ALLY now is because it’s cheap. Despite the recent rally and the market trading at new highs, ALLY sells at just 8.4 times forward earnings and 0.93 times book value. Both valuations are well below those of the market averages.

Meanwhile, the financial sector is the best performing sector in the S&P since the election. Many industry-leading stocks have flown to all-time highs.