Medpace Holdings Inc. (MEDP) is a leading Contract Research Organization (CRO) focused on helping small- and mid-sized biotechnology, pharmaceutical, and medical device companies conduct clinical trials essential for drug approval, highlights Pieter Slegers, editor of Compounding Quality.

Founded in 1992 by CEO August Troendle, who owns nearly 25% of the company, Medpace specializes in providing outsourced clinical development services. Unlike biotech companies, Medpace does not develop drugs. Instead, it supports clients in navigating complex regulatory and clinical trial processes.

This niche focus allows Medpace to establish strong client relationships, as CROs like Medpace can speed up trial timelines by up to 30% compared to in-house trials, reducing drug development costs that often exceed $1,000 million.

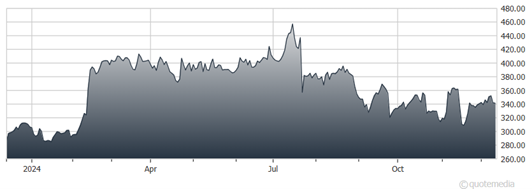

Medpace Holdings Inc. (MEDP)

Medpace’s competitive advantage lies in its deep expertise in late-stage trials, global reach, and the high switching costs it creates for clients. Its understanding of diverse regulatory and cultural environments strengthens its ability to conduct multinational trials.

With the CRO industry projected to grow at an annual rate of 11.5% through 2030, Medpace’s 3% market share positions it to capture growth within this fragmented market. Major competitors include Icon, Syneos, and Iqvia, though Medpace’s conservative financial management and high profitability distinguish it.

The company operates with a gross margin of 67.2% and a profit margin of 17.7%, translating most earnings into free cash flow. Medpace’s financial strategy emphasizes organic growth, evidenced by its strong return on invested capital (ROIC) of 30.2% when excluding goodwill from a 2014 private equity acquisition.

The company refrains from paying dividends, but occasionally repurchases shares, optimizing shareholder value without heavy capital expenditures (CAPEX is just 1.9% of sales). Over the past five years, Medpace’s revenue and free cash flow per share grew annually by 20.3% and 29.5%, respectively, indicating robust performance in a steadily growing market.

Future projections estimate revenue and EPS growth of 10.2% and 15.2% per year over the next five years, driven by increasing outsourcing in clinical trials and demand for specialized CRO services.

Trading at a forward price-to-earnings ratio of 28.7x, Medpace may appear costly. However, strong growth prospects justify this valuation. Since its 2015 IPO, Medpace has delivered an impressive annual growth rate above 35%, underscoring its consistent track record in creating substantial shareholder value.

Subscribe to Compounding Quality here...