Financials were acting decently before the election. But as a whole, they look to have kicked off a powerful sector move since then, with the payments subsector (especially new-age players) helping to lead the way as investors anticipate accelerating bottom-line growth ahead. Toast Inc. (TOST) is a name we like, writes Mike Cintolo, editor of Cabot Growth Investor.

It looks like perception is improving as the firm’s excellent underlying story is now meeting with rapidly rising margins to give the firm an emerging blue chip-sort of feel. Toast is best known as the hands-down, new-age cloud leader in payments solutions for restaurants. That is a gigantic market of 875,000 locations in the US and another 230,000 in Canada, Britain, and Ireland.

Toast Inc. (TOST)

But really, the story here goes far beyond point-of-sale solutions and order processing. Its platform helps clients with scheduling, tip management, email and text marketing and reservations, invoicing, payroll processing, and a ton more. Toast currently has more than doubled its market share in the US during the past three years, but has “only” 14% of the market. Many out there are still using inefficient legacy systems.

It’s also moving into other food and beverage retailers (think convenience stores and the like), which is a huge 220,000-location opportunity. In Q3, the top-line metrics were all to the good — sales up 26% and annualized recurring revenue up 28%. But what caught the market’s eye was the huge beat on the bottom line, with EBITDA of $113 million up more than three-fold from a year ago.

Management also significantly hiked estimates for the rest of this year, which adds credibility to its longer-term forecast released back in May. Toast thinks its EBITDA margin can reach 30%-plus within a couple of years and 40% in the long run, up from 26% in 2024.

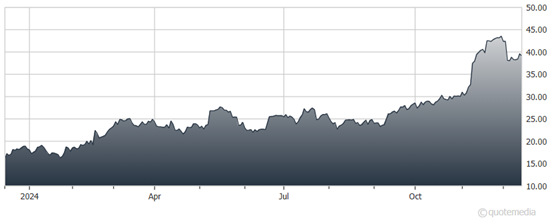

The stock previously had numerous failures in the mid-to-upper $20s. But TOST moved above that area in October and then mushroomed in November, with three straight, huge-volume buying weeks after the Q3 report. That sort of power early in an advance isn’t likely to dissipate quickly. Just the opposite, in fact, as it’s looking like TOST has finally begun a major uptrend after years of bottoming out.