Similar to how investors underestimated foundry chip stocks in 2023, data center companies are being undervalued as 2025 gets underway, with Artificial Intelligence (AI) now front and center. Dell Technologies Inc. (DELL) is well-positioned for growth, driven by several key factors, suggests Matthew Timpane, editor at Schaeffer’s Investment Research.

The company is seeing strong demand for AI-optimized servers, especially from tier-2 cloud providers, AI cloud service providers (CSPs), and enterprise/sovereign clients. AI server orders reached $3.2 billion in F2Q25, with a backlog of $4.5 billion in F3Q25.

Dell’s traditional server business is also recovering, with five consecutive quarters of sequential growth and three consecutive quarters of year-over-year growth. The storage segment is also benefiting from a shift toward Dell’s proprietary solutions, which are improving margins.

Dell's financial outlook is strong, with rising earnings expectations for 2025. Free cash flow generation is expected to remain robust, supporting shareholder-friendly capital return programs. The company’s strong financial position and leadership in the AI infrastructure, servers, and storage markets make it an attractive investment heading into 2025.

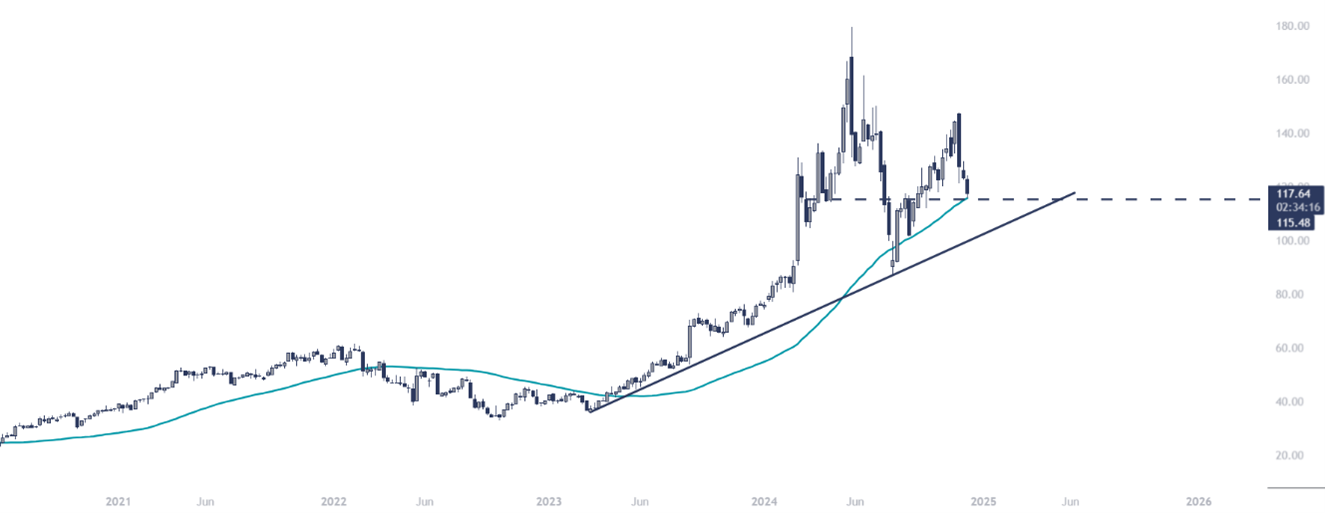

On the technical side, DELL is pulling back to its 252-day or 52-week moving average, providing a potential opportunity for investors to enter this AI-driven growth story at a favorable price. Despite the second-half pullback, the stock was up over 50% year-to-date in 2024 through mid-December, with support around the $115 level following its post-earnings spring movement. Any dips toward the round $100 level should be considered as an opportunity, using that level to define risk.

In the options market, put sellers are active at the $100-strike and extending to deep in-the-money $170-strikes for 2025, suggesting strong support for the stock and positioning for stability. Additionally, aggressive out-of-the-money call sweepers have appeared, including a significant sweep of the June 195-strike calls, signaling expectations for substantial upside.

The high 50-day buy-to-open put/call volume ratio (96th percentile) indicates that premium buyers may be too pessimistic about the stock, setting up for a potential sentiment reversal.

Dell's Schaeffer's Volatility Index (SVI) of 36%, which is in the 22nd annual percentile, shows that low volatility is currently priced into the stock’s options. However, the company’s consistent ability to reward premium buyers, as evidenced by its Schaeffer’s Volatility Scorecard (SVS) rating of 85, suggests the stock may experience larger-than-expected moves compared to the options market’s low volatility expectations.