Fresh out of college, Jake Bernstein developed observations about abnormal behavior in his work at a Chicago mental hospital. Decades later, those experiences helped this trading legend spot abnormal market behavior and opportunities. You can too. Last of three weekly parts.

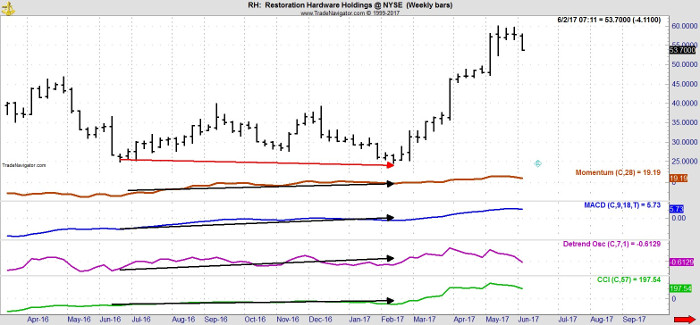

In the last two installments of this series, I discussed the value and importance of divergence as a leading indicator to market behavior, stressing the idea that traders do best when they employ leading indicators as opposed to lagging indicators. My research with momentum as a tool for spotting divergence strongly suggests that this approach can give traders and investors a powerful edge. In addition to momentum, I have found MACD, the detrended oscillator, and the CCI to be valuable tools in helping traders identify divergence setups and triggers. The chart below illustrates each indicator along with the divergence pattern it presents for that particular stock prior to a significant change in trend.

The chart above shows Restoration Hardware (RH) weekly data with four indicators I use to assess divergence. Note that when the stock established a new low in price, all for the indicators established higher lows. The price rally that followed is a classic example of divergence set up, trigger, and follow through.

The salient points to ponder and employ in a trading strategy implementing divergence are:

- the divergence indicator must be accompanied by a solid set of rules which provide information on set up, trigger, and follow through.

- to effectively use divergence or for that matter any purely objective indicator is a timing trigger there must also be an accompanying profit maximizing strategy.

- the divergence set up should be easily recognizable and algorithmic to the extent that it can be programmed on a computer, thereby allowing the computer to find divergence setups for us.

- divergence can occur in all time frames and in all markets provided there is sufficient trading volume (liquidity).

- although it is de rigueur to engage in short-term or quick in and out day trades, divergence is best used to spot intermediate and longer-term trading opportunities inasmuch as the big money has been and will continue to be made in the big move unless traders wish to trade very large positions for small moves.

The information presented in this three-part series scratches the surface in terms of what divergence can do for traders. Modern computer technology and processing capability readily allows identification and back testing of divergence setups and triggers in order to determine the statistical efficacy of the divergence-based approach. As always, drop me a line if you have questions or comments.

Subscribe to The Jake Bernstein Online Weekly Capital Markets Report and Analysis here…