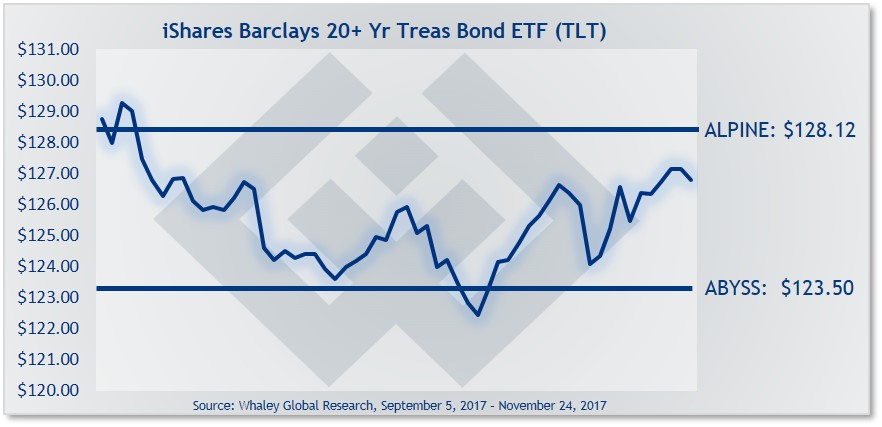

Trade idea: As long as TLT trades below $129.00, then new short trade ideas can be initiated between $125.19 and $128.12. Depending on how much room you want this idea to move, use a risk price between $127.52 and $129.00, suggests Landon Whaley of Focus Market Trader.

The iShares Barclays 20+ Year Treasury Bond ETF (TLT) gained 32 basis points in the week ending November 17, pushing its year to date gain to 6.4%.

Wall Street continues to fear the bond market is signaling danger ahead for the U.S. economy. Multiple U.S. yield curves are at the flattest levels in a decade caused by 2-year yields pressing higher.

The fear mongers out there will tell you that seven out of the last seven U.S. recessions have been characterized by an inverted yield curve.

An inverted yield curve is when 2-year Treasuries pay more than 10-year Treasuries.

Despite what the gloom and doom crowd would have you believe, there is virtually no risk of a U.S. recession during 2018. U.S. growth will slow but growth slowing is a completely different beast than a recession.

What’s more, the current yield curve flattening is about supply and demand in the bond market, not about the health of the economy. I’m sticking with the short bias and I’m back with a brand new short trade idea because I’m not deterred one bit by a flattening curve.

Trade idea

As long as TLT trades below $129.00, then new short trade ideas can be initiated between $125.19 and $128.12. Depending on how much room you want this trade idea to move, use a risk price between $127.52 and $129.00.

Your risk price line in the sand is $129.00, if TLT touches that price, even for a second, then you should exit any open trades.

If the trade moves in your favor, then you could consider using the price range between $123.54 and $122.19 as your profit target.