After the Wednesday night hostilities in Syria, so much for the brevity of the S&P 500 (SPX) rally above trend, other than to the extent Semiconductors and a spike in Oil are sufficient, writes Gene Inger.

I wondered all Wednesday about the Oil rally because it suggested more tension in a sense that the market was revealing or the inventory drawn-down here in the U.S. would impact the market. (API data is not that big of a deal at this level.)

Oil slips Thursday on profit-taking from Iran-based rally.

So, stay tuned and realize that markets may not be jammed overbought. At the same time, they are of course vulnerable to exogenous events.

Wednesday the pot was stirred and issues simmered for the most part, as responses globally were not dramatic, and although lots of tension remain. Some visibility for resolutions seems conceivable too.

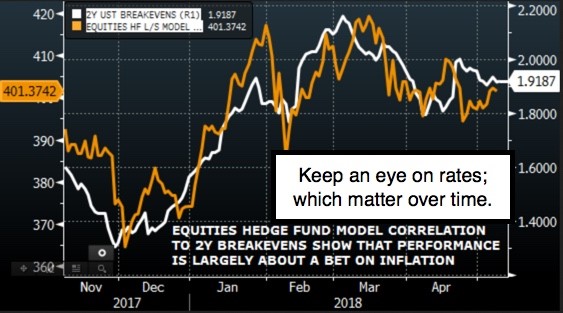

At the same time, credit markets press areas that should attract attention. As will likely be cited by optimists as a reason, should markets soon falter and retreat after probably probing slightly higher on the very near-term.

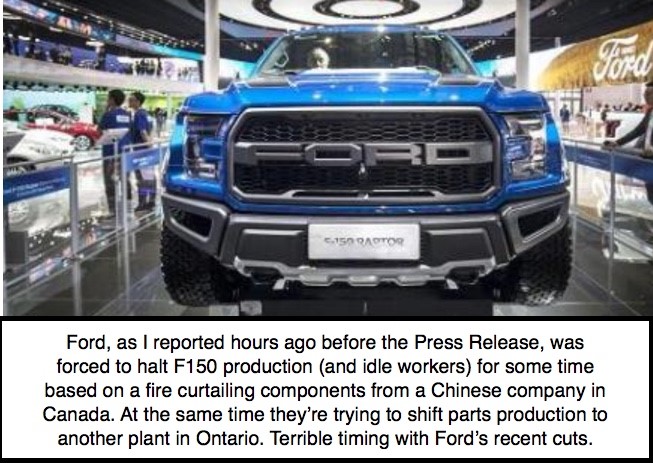

The Ford (F) official announcement of temporary halts in F-150 truck production came after the Wednesday close. The story was already out with relatively minimal impact. The only odd part is sourcing from single source suppliers (in this case a custom magnesium component).

In the case of Ford, we also think they’ll work through it, both it and GM (GM) are near the year’s lows, as a result of consumer demand slowing, which evolving loans show too. Of course, they got bloated with the temporary surge after both hurricanes Harvey and Irma flooded or ruined over a million vehicles.

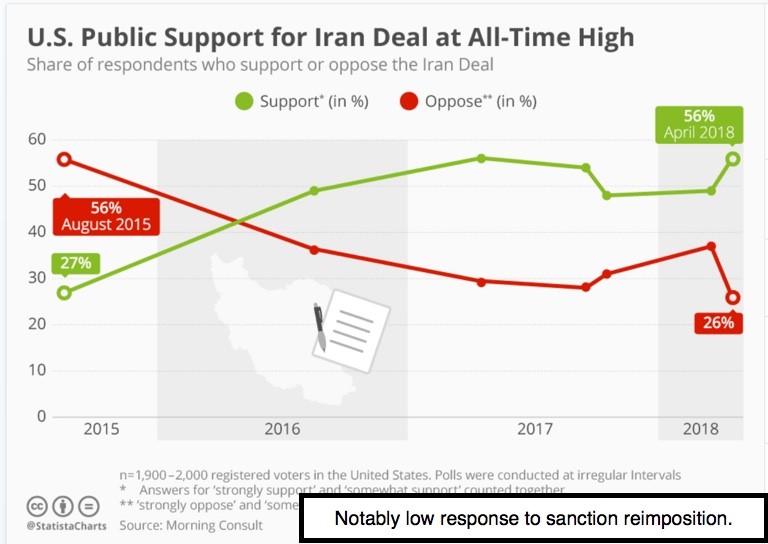

In-sum: led by Oil and Tech, you have a market ignoring higher rates and notably unconcerned about the Middle East. Sure, we are hopeful that Tehran (and Moscow for that matter) will defuse matters; primarily because they need to escape sanctions. The jury’s out on it.

The Guardian: China's ZTE may be first casualty Thursday in trade war with US.

Now the notion that markets can go up with rates regardless is what the pundits say now. Watch them turn and blame credit markets when (of course, not if) the rally exhausts itself and reverses.

Asian markets moderately higher Thursday, tracking overnight gains on Wall Street: AP.