Food delivery firm GrubHub (GRUB) jumped on our radar this week, after the stock sent up a signal that has preceded big short-term buying opportunities in the past, writes Elizabeth Harrow Wednesday.

Specifically, with GRUB fresh off the new 52-week high of $113.61 set on June 5, its Schaeffer’s Volatility Index (SVI) of 38.2% -- a measure of implied volatility on short-term options -- arrived in just the 7th percentile of its annual range.

Since GRUB stock made its public trading debut in 2014, there have been only six other occasions where the equity was trading within 2% of its annual high while its SVI was in the 20th annual percentile or lower. Following those previous six “high stock price/low implied volatility” signals, GRUB was higher 83% of the time one month later, with the average return for that period weighing in at a healthy 8.93%, according to Schaeffer’s Senior Quantitative Analyst Rocky White.

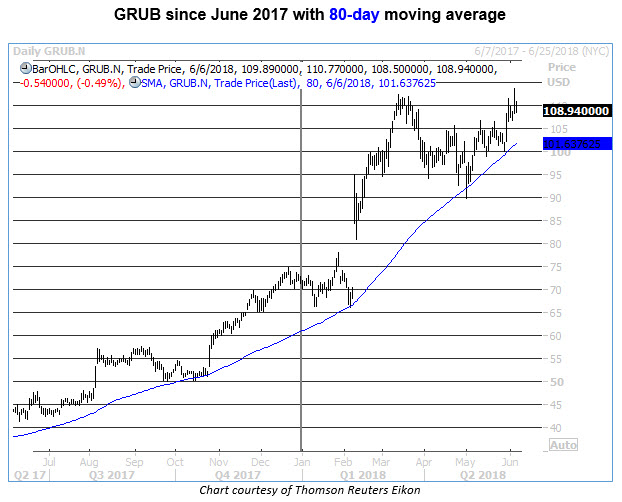

This latest signal comes as GRUB attempts to make a decisive move above its record closing highs in the $111 neighborhood, set back in March. From a broader perspective, the shares have more than doubled in value over the past 52 weeks, with a few pullbacks over this time frame easily supported by GRUB's rising 80-day moving average. And as of this writing, the stock is pacing for a fourth consecutive daily close above the $107.70 level, which corresponds with a round 50% year-to-date return.

Checking out the stock’s sentiment backdrop, GRUB looks well-positioned to benefit from an unwinding of pessimism among analysts and traders alike. For starters, the outperforming equity has garnered 14 Hold or Sell ratings from brokerage firms, compared to only nine Strong Buy ratings. This skeptical configuration leaves plenty of room for future upgrades to bring more buyers to the table.

Bullish initiations are a possibility, too. In fact, as recently as May 31, Canaccord Genuity started coverage with a Buy rating, with the firm citing GRUB’s “large addressable market, low penetration, competitive advantages, and strong management” as the impetus behind the endorsement.

Plus, GRUB’s ongoing rally has short sellers running for cover. Short interest on the stock declined by 4.1% over the past two reporting periods, but still accounts for a significant 20.7% of float. At GRUB’s average daily trading volume, it would take more than nine days -- or nearly two full weeks’ worth of trading days -- for all of these bearish bets to be covered.

With the stock on strong technical footing and boasting a healthy supply of sideline cash (in the form of short interest) to support additional upside from here, this latest high stock price/low implied volatility signal from GRUB is one that contrarians shouldn’t miss.

View Schaeffer’s Investment Research for stock and options ideas, options education, and market commentary here