In part one and two of this series on small trader sentiment I introduced The Daily Sentiment Index as an objective metric to assess the level of bullish or bearish sentiment levels of the small trader, writes Jake Bernstein. He's presenting at TradersExpo Las Vegas.

The DSI is used to determine if small trader sentiment was a valid predictor or leading indicator of market tops and/or bottoms.

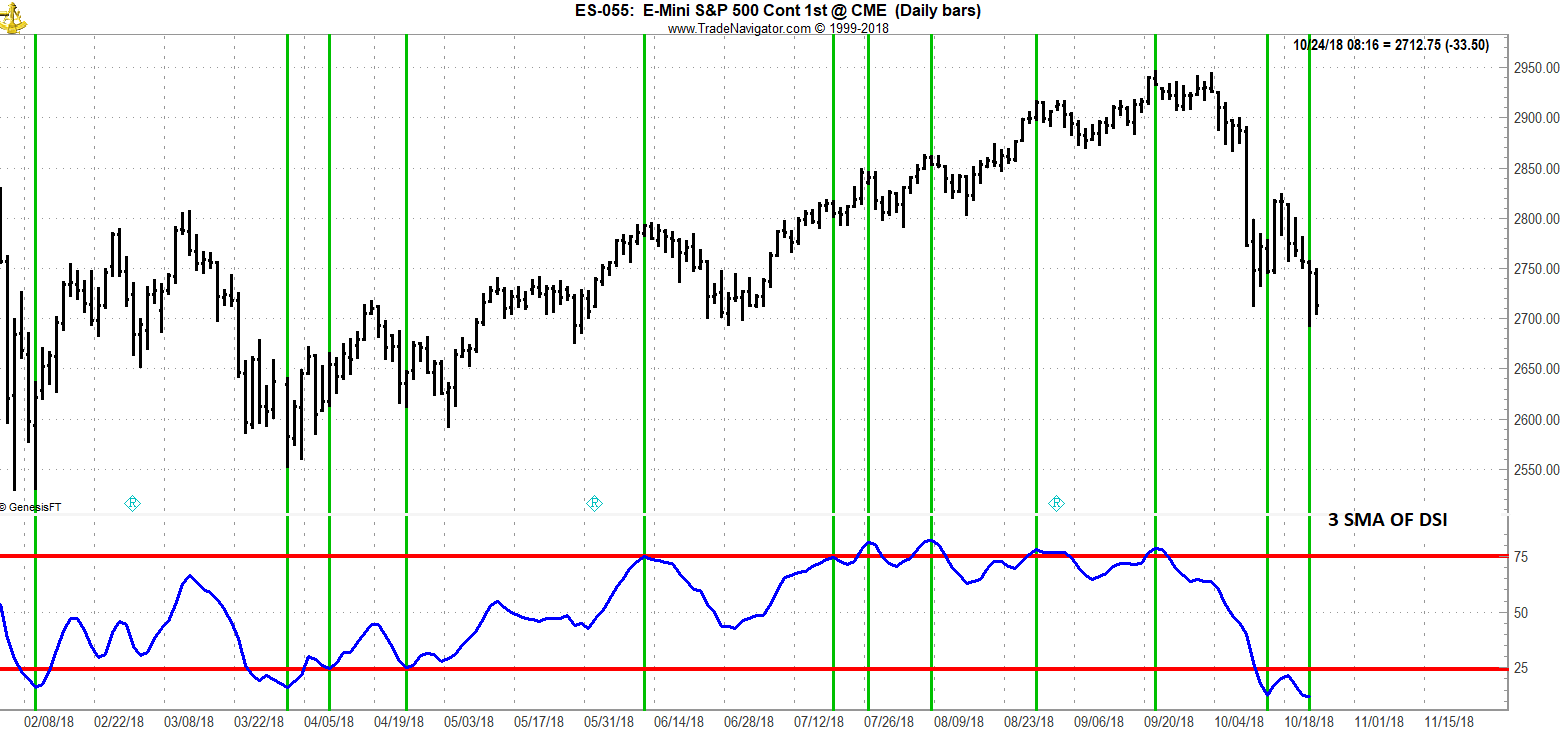

Shown below is the current daily S&P futures chart with the three-day moving average of the raw Daily Sentiment Index shown at the bottom of the chart.

I have highlighted with vertical bars areas of “excessive” small trader bullishness and “excessive” small trader bearish sentiment. As you can see from a close examination, the correlation appears to be significant with small trader sentiment being a leading indicator or time current indicator of short-term tops and bottoms. Note that extreme readings of the sentiment index tend to lead small and large moves in S&P futures or frequently they correlate to the very high or low of the move.

After studying data on the Daily Sentiment Index on all actively traded U.S. futures markets dating back to 1987, here are my general conclusions about small trader sentiment and prices:

- The small trader is not always wrong. However, extreme levels of small trader sentiment tend to precede or closely correlate with highs and lows and prices.

- The small trader Daily Sentiment Index is a set up and not a trigger. By this I mean that The Daily Sentiment Index is an early warning system which is ideally combined with timing triggers for market entry and price targets as well as stops for risk management.

- When combined with other indicators, the Daily Sentiment Index can be a very helpful filter for various strategies.

- The Daily Sentiment Index does its “best work” when it has dropped to or rallied to extreme levels.

- Small trader sentiment can remain excessively high or excessively low for extended periods of time which is why traders should not act immediately upon seeing excessive levels but rather combine the index with timing work to improve precision.

The chart below shows current status of S&P futures with DSI. Over the next week or two will see how this turns out.

At this point in time the Daily Sentiment Index is suggesting that a low is in the process of developing. Not coincidentally this comes at a time when seasonal lows tend to be made. DSI information is available at jakebernstein.com

Best of trading!

Jake Bernstein

www.trade-futures.com