Wednesday and Thursday’s sessions were more of the same as it was another expected consolidation, reports Ricky Wen of ElliottWaveTrader.net.

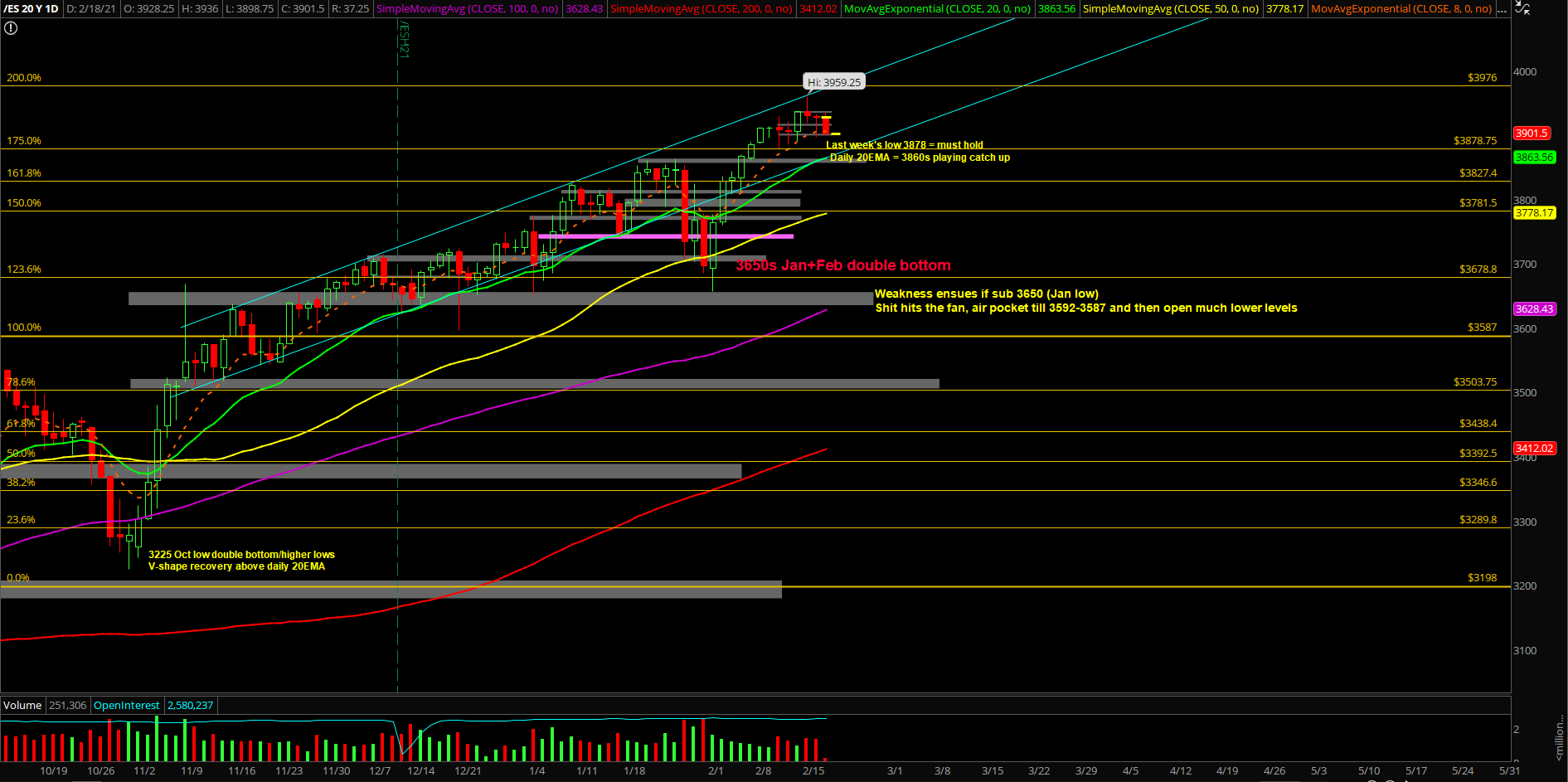

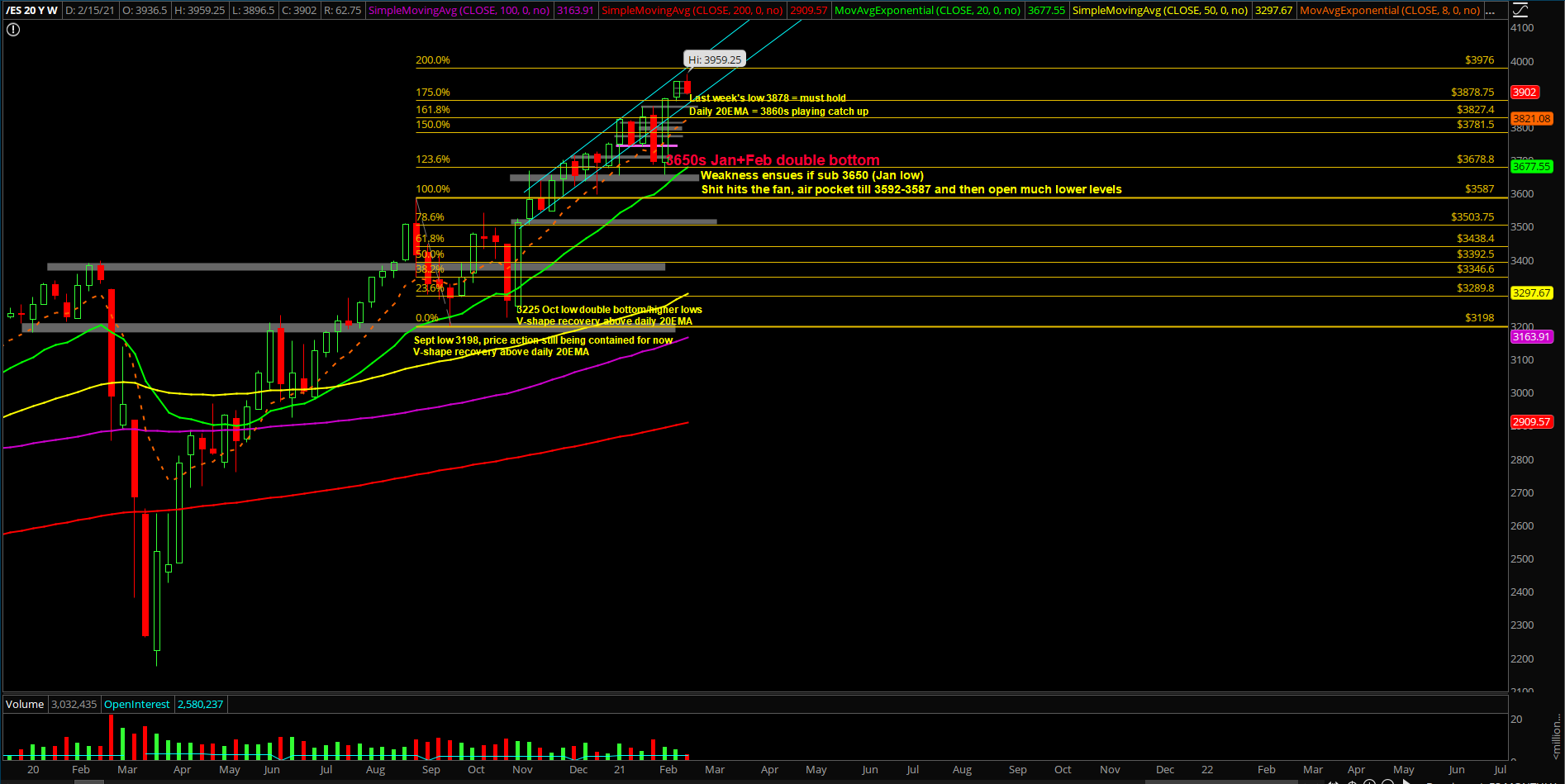

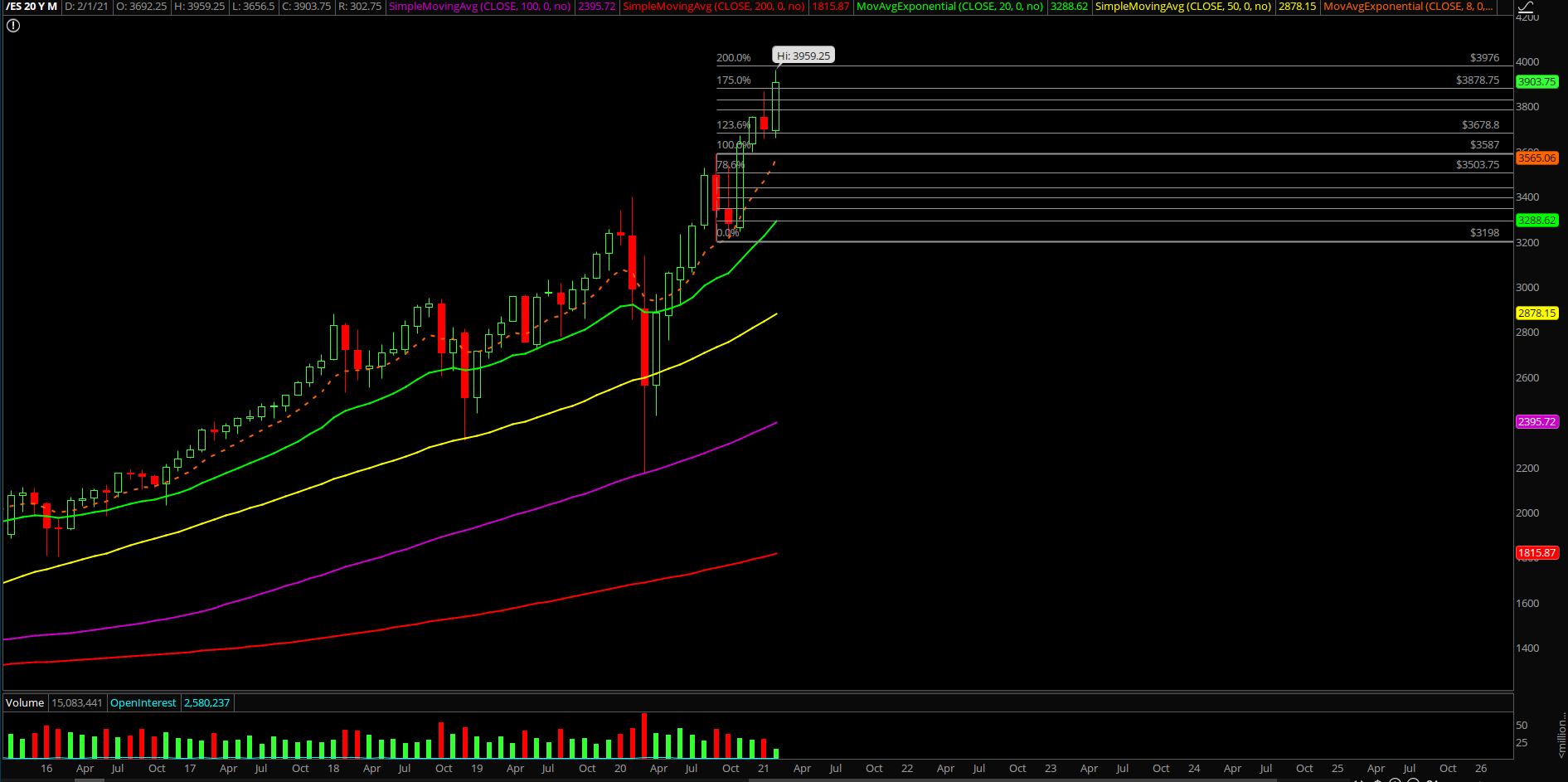

If you recall, it was early in the pattern, so patience is needed given the past two weeks’ V-shape performance totaling +8% from the 3650s low to the 3950s high on the Emini S&P 500 (ES).

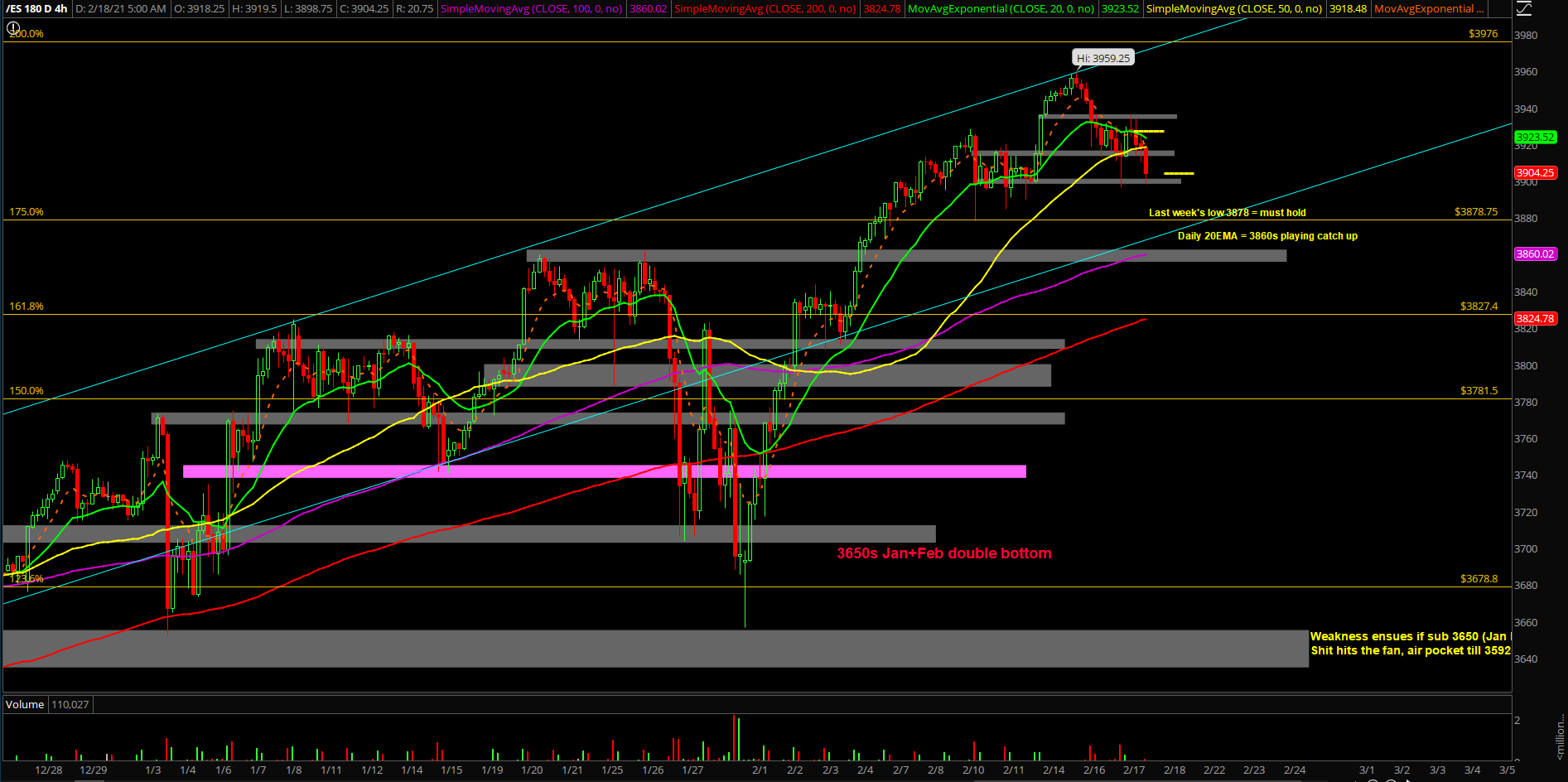

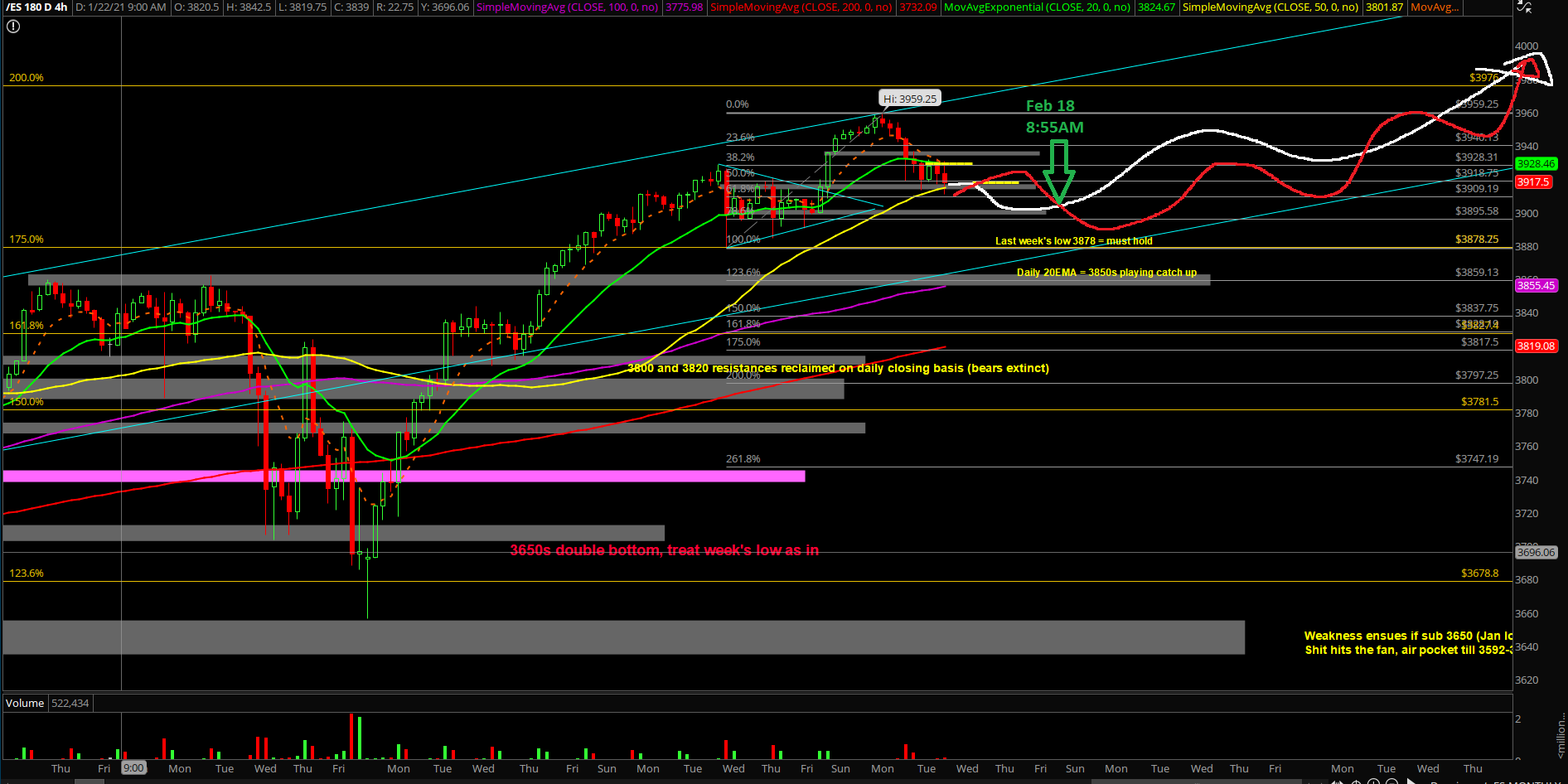

Pivotal sessions took place given that both sides were trying to win the battle. Bulls were trying to stabilize a temporary low so the train can finalize a route towards new all-time highs again. Bears were trying to break below last week’s low and below the trending daily 20EMA to cause a derailment.

The underlying context remains the same, with the main takeaway being that this one-three-day consolidation must keep holding above last week’s low 3878 in order to confirm that short-term momentum is not weakening too much. Price action is just trying to find the next higher lows setup on the daily/weekly basis in order to ramp again given the context of the bull train. However, if support starts going, then it’s going to brake check everyone on the train and that’s when the carnage could begin. For now, focus on dip opportunities vs. our key trending support levels.

What’s next?

Thursday closed at 3929, which is basically where Tuesday and Wednesday closed at as well. Price action indicates consolidation/digestion as there is no breakout back above 3950 yet to confirm that bulls are ready to ramp higher. For now, the price action is following our 4hr red line projection. Adapt.

Some key summary points:

- On Monday, price action hit a temporary high of 3959.25 as it got rejected vs. the multi-month uptrend channel in order to consolidate/digest a bit first before reattempting higher highs.

- Thursday is day #4 of the consolidation/digestion pattern; see if price action can do something more decisive. Need to see a turnaround to start confirming things.

- Watching to see whether we can accumulate on this dip opportunity once it stabilizes for another ride towards the 3976 target, then 4000 major psychology number. Remain patient.

- The must-hold support for this week is located at 3878, which was last week’s low. Meaning dips are still being treated as buyable opportunities when above this support. FYI, daily 20EMA = 3860s for reference and keep grinding higher to play catch up (daily closing print matters).

Ricky Wen is an analyst at ElliottWaveTrader.net, where he hosts the ES Trade Alerts premium subscription services.