Exactly a year ago, I wrote a blog post arguing the bullish case for things like copper, precious metals, oil, etc, recalls Jesse Felder of The Felder Report.

Since then, the Bloomberg Commodity Spot Index has almost doubled in value, leading some to believe it may now actually be overvalued.

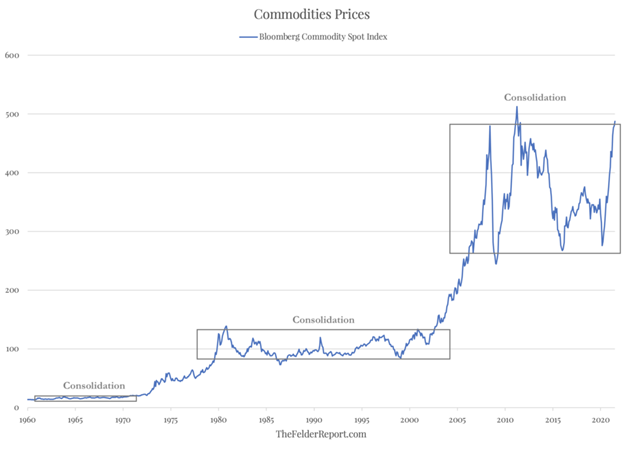

However, commodities have been in a consolidation phase for well over a decade now. The consolidation phase seen during the 1960’s lasted just about as long as the current one; the subsequent breakout higher proved to be a good inflation signal. The next consolidation phase, during the 80s and 90s, lasted more than twice as long as it was marked by a prolonged period of disinflation.

How commodities act going forward could prove, once again, to be a decent signal about the nature of the current inflationary episode. Considering the fact that, despite their terrific run over the past 12 months, commodities prices remain extremely depressed relative to those of financial assets, it should not be surprising to see them break out of their recent consolidation range. Additionally, supply/demand dynamics appear to be improving every day.

A clear breakout higher in the commodities index would probably represent the death knell of the Fed’s “transitory” narrative regarding inflation, which investors have bought hook, line, and sinker. As such, it could also usher in a wave of investor demand for the sort of inflation protection only commodities can offer. Markets are just reflexive that way. So, it may pay to stay bullish and to keep a close eye on the upper end of that most recent consolidation range.

Learn more about Jesse Felder at TheFelderReport.com.