I spotted an anomaly in the market last week which makes me wonder what may happen next. And here is a hint: something big may be brewing, says Joe Duarte of In the Money Options.

I’ll tell you about it in detail in the market breadth section directly below.

But first, I’d like to offer some background thoughts on how the inner workings of complex systems such as the options markets function, because it will help to understand what may be happening.

Complexity is Not Perfect

Complexity is best defined as a process which has many moving parts (agents). These agents are always interacting with one another and the environment. And although you can say the same thing about chaos, the difference between the two is that the ultimate goal of chaos is disorder, while that of complexity is the opposite—the creation and perpetuation of nonlinear order.

In other words, while chaos is a complete dysfunctional mess, complexity is all about function. In other words, in terms of complexity, perfection is relative and is more akin to function rather than aesthetics or ideal outcomes.

The stock market is a complex system, and lately has been looking increasingly ill. And like all complex systems, when its time comes, it will fail.

That said, and even though the Fed is at the top of the guilty list as a cause for a potential market crash, there are plenty of other reasons that may serve as the excuse for a sizeable decline—if and when it comes.

Ironically, many of the reasons complex systems fail are actually built into the way complexity works.

So here is the thing. All complex systems are built with failure as part of the operating system. In fact, here is an interesting summary of how these things happen, courtesy of Dr. Richard Cook.

Dr. Cook offers 18 observations about complex systems, which are all self-evident. But in this article, I will name eight of them, and combine them into a single thesis.

Regarding complex systems:

- They are inherently hazardous.

- They are heavily and successfully defended against failure.

- Catastrophe requires multiple failures as one failure is not enough.

- They contain failure as latent component.

- They run in degraded mode.

- Catastrophe is always just around the corner.

- All practitioner actions are gambles.

- Change introduces new forms of failure.

Anyone who can read between the lines will recognize that the above listed bullets can be summarized into one term—risk. In other words, a system such as MELA—the Markets, the Economy, People’s Life decisions, and Artificial Intelligence—is risk personified.

And although these systems are durable, highly adaptive, and “heavily defended against failure,” they still run in “degraded mode.” As a result, there is only so much they can take before a major negative event takes place.

After all, given that under normal operating circumstances “all practitioner actions are gambles,” and that “catastrophe is always just around the corner,” there should be no surprise that given the current state of affairs, the market is increasingly volatile.

Welcome to the Edge of Chaos:

In other words, I am describing the potential for a short-term trade featuring EOG Resources Inc. (EOG), based mostly on technical factors. Meanwhile a quick review of the price chart shows a familiar trading pattern:

- Short sellers are nearly exhausted as ADI has bottomed out and is starting to move higher.

- Buyers are coming back as On-Balance Volume (OBV) is turning up after an intermediate pullback show signs of perking up.

- The stock has broken out above fairly significant Volume by Price (VBP) bars, which as I’ve noted before means that the algos are using intraday dips to nibble at the shares.

So, do I think EOG is going to go up forever? Of course not. But right now, it looks a lot better than many other stocks in the market.

I own shares in EOG as of this writing.

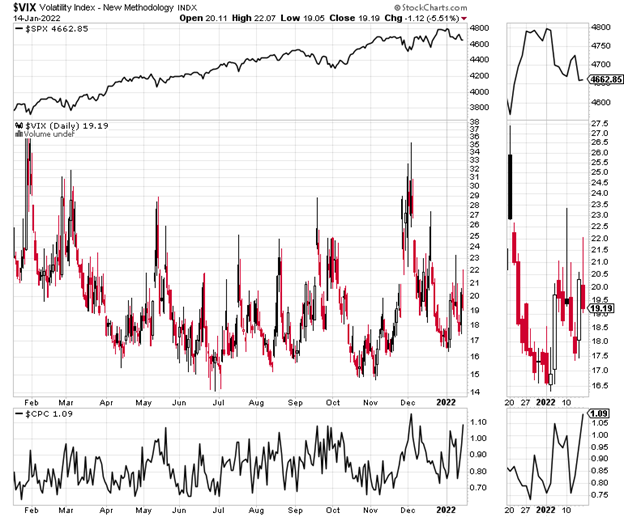

VIX and NYAD Hit Crucial Red Lines Simultaneously

Keep a close eye on the 50-day moving average for NYAD and the 20 area for VIX. If the market continues to act as it did over the last week, further breaches of these two levels are likely to lead to more aggressive selling.

Market Makers Are Hedging Against A Big Development

Here we go. By the end of trading on 1/14/21 we had a bit of a divergence. As the chart below shows, NYAD was heading lower, but did manage to remain above its now down trending 50-day moving average.

Meanwhile, the CBOE Volatility Index (VIX) line shows that VIX ended the day lower and that it remains below 20.

Remember that a rise in VIX means that put option volume (bets that the market is going to fall) are on the rise. Also remember that when put volume rises it means that put buyers are causing market makers to sell puts. When market makers sell puts, they have to sell stocks and stock index futures to hedge their put sales.

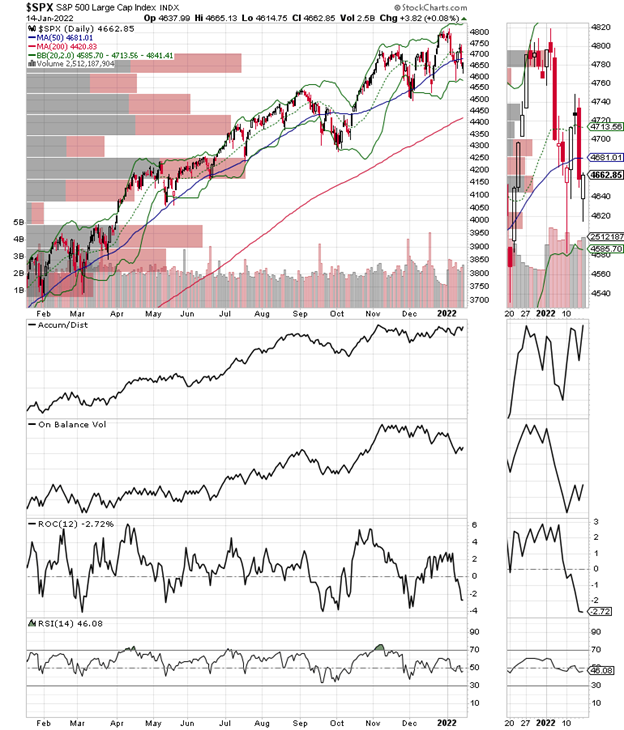

The S&P 500 (SPX) is showing signs of accumulation with Accumulation Distribution (ADI) and On-Balance Volume (OBV) holding up as stocks found a bid (see options discussion above) on Friday afternoon. SPX is still below its 50-day moving average, but the trading pattern is certainly interesting.

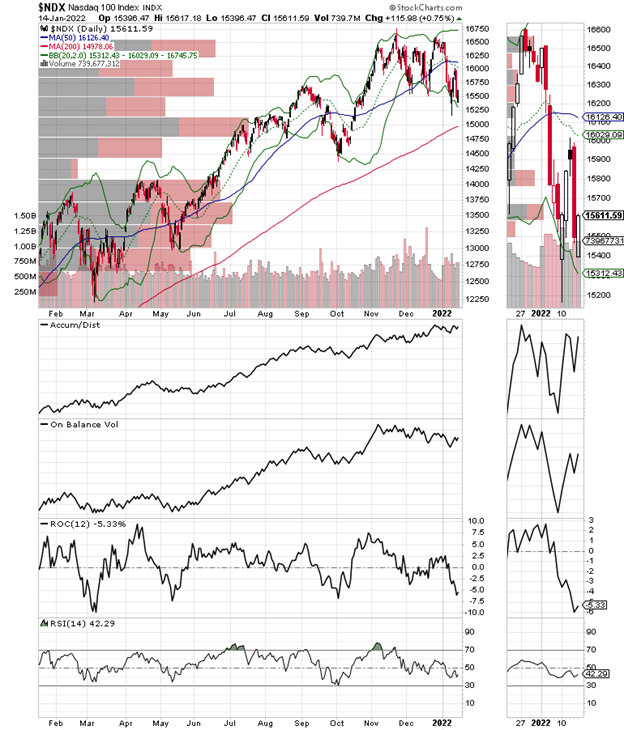

The Nasdaq 100 Index (NDX) did not break down, although it remained below its 50-day moving average and is still testing key support at 15,500 or so. A break below this area could well take the index down to a test of the 200-day moving average.

The S&P Small Cap 600 Index (SML) remains range bound, mostly going nowhere.

The Market Makers Are Protecting Their Shops

Let’s put it all together now, based on the eight tenets of complexity I named above along with our chart review.

As best as I can tell, the market makers have noted that risk is rising. As a result, they are aggressively defending their accounts against failure by aggressively hedging all bets on both the long and the short side.

Since catastrophe requires multiple failures as one failure is not enough, it’s hard to know when the proverbial straw that will break the camel’s back will come. But the market makers can sense that it could be coming closer.

The market makers know that complex systems contain failure as a latent component, and that they run in degraded mode. Moreover, they know that catastrophe is always just around the corner and that all practitioner actions are gambles while appreciating the fact that change introduces new forms of failure.

So, what’s the bottom line? Something big is coming. If it weren’t, the market makers wouldn’t be battening down the hatches.

To learn more about Joe Duarte, please visit JoeDuarteintheMoneyOptions.com.