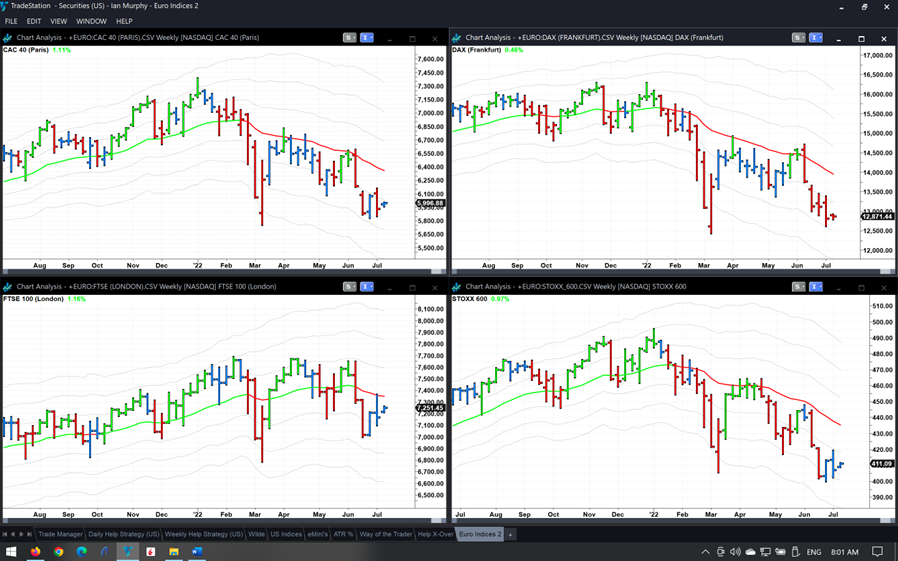

While traders and investors in the States celebrated their holiday off, let’s turn our attention to European stock markets as we focus on the CAC40 (FCHI), DAX (GDAXI), and pan-European STOXX600 (STOXX), writes Ian Murphy of MurphyTrading.com.

Click charts to enlarge (Data Sources: Yahoo Finance & Investing.com)

All three indices have an almost identical pattern. We had a steep selloff in March which breached the -3ATR channel on a weekly chart, followed by a powerful bounce that ran out of steam at the falling moving average. Currently, all three are trading below their -1ATR line which confirms the bearish trend.

Also, notice how the 21-period EMA has been red since the beginning of the year in each case.

Things are a little different across the Channel where the FTSE100 (FTSE) in London has outperformed its continental peers and appears to be weathering the bear market a little better. It is back in the neutral zone and the EMA was green for April and May.

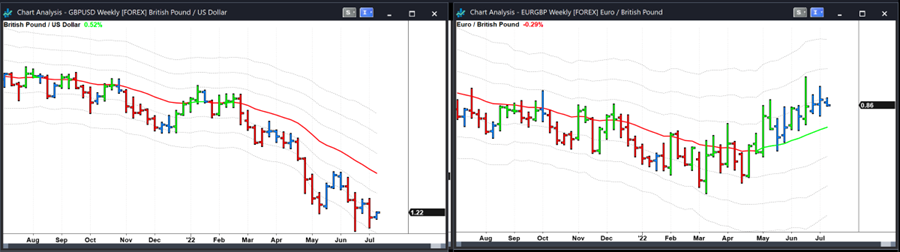

Click charts to enlarge

However, when currencies are taken into account, the British Pound (GBP) has been falling steadily against the US Dollar (USD) and Euro (EUR/USD) especially since April, making the market less attractive for overseas investors in UK equities, but a good home for Pounds right now.

Learn more about Ian Murphy at MurphyTrading.com.