Bears are suddenly in a serious state of distress with short positions in technology shares, and they know it, states Jon Markman, editor of Strategic Advantage.

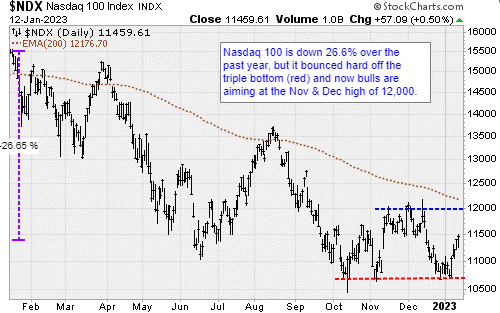

The tech-heavy Nasdaq 100 Index (NDX) rose Thursday to 11,460, a gain of 0.5%. More importantly, the benchmark index sailed through what should have been important resistance at 11,360, the 50-day moving average.

This advance is significant because it comes as the cornerstone for the bearish tech narrative crumbling. Interest rates are collapsing. The Ten-Year Treasury yield slipped Thursday to 3.4% after the December consumer price index report showed that inflation is waning.

Yields are falling even faster for long-dated government and high-quality corporate bonds. This means greater corporate access to capital and a higher net present value for future earnings in investment models.

Professional money managers will use this development to step up investment in beaten-down technology issues. And those issues could rally substantially.

The next important resistance level is 12,000, the November and December high. One way or another, I expect a test of that level during the next several weeks. There is a critical support for the NDX at 11,090.

The QQQ Loop Trade: Let’s try again, sigh. Buy the ProShares Ultra QQQ (QLD) at $36.20 lmt gtc. The QLD is an exchange-traded fund that delivers twice the daily performance of the Nasdaq 100 index. If filled, place a new order to sell half of the position at $37.49 and half at $41.90. Place a new stop loss order at $34.00 stp. If this trade works, the potential upside target is +3.5% and +15.7%. The potential downside risk is -6.3%.