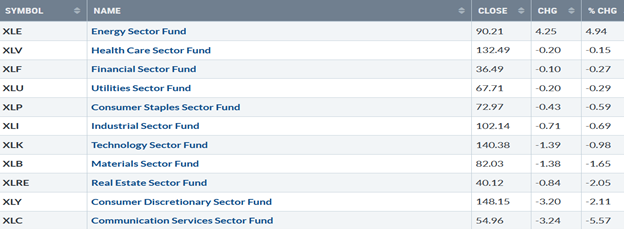

The 2023 advance stalled, with only one of eleven S&P SPDR sectors being higher, notes Bonnie Gortler of bonniegortler.com.

Energy (XLE) and Healthcare (XLV) were the leading sectors, while Consumer Discretionary (XLY) and Communication Services (XLC) were the weakest, with the SPDR S&P 500 ETF Trust (SPY) down -1.05%.

S&P SPDR Sector ETFs Performance Summary 2/3/23 – 2/10/23

Source: Stockcharts.com

Figure 2: Bonnie's ETFs Watch List Performance 2/3/23 – 2/10/23

Source: Stockcharts.com

Both the International and US market were lower last week. Small Cap Value and Growth and Transportation were the weakest. Hi-yield Bonds fell more than the S&P 500, implying investors were unwilling to take risks and somewhat cautious.

Figure 3: CBOE Volatility Index VIX

Source: Stockcharts.com

The CBOE Volatility Index (VIX), a measure of fear, traded above 20.00 for most of 2022. In late January 2022, VIX made a high at 36.95 on 3/7 (blue circle) and a low on 4/1/22 at 18.57. A new VIX low didn’t occur until 1/13/23 at 18.35 (green circle) after VIX quieted in early December 2022.

Last week, VIX closed higher at 20.53 (pink circle), breaking the downtrend from December 2022 as all the major averages moved lower. If VIX continues to rise and closes above 24.00, look for the pullback to turn into a potential significant correction. However, if VIX remains below 24.00, which I am expecting, only a pullback is likely before another rally attempt soon.

The major averages for the week were lower. Dow was down -0.15%, S&P 500 was down -1.11 %, and the Nasdaq fell -2.41%. The Russell 2000 Index declined -3.46%, the weakest of the averages, giving back all its gains the previous week, and the Value Line Arithmetic Index (a mix of approximately 1700 stocks) fell -2.44%.

Weekly market breadth was negative on the New York Stock Exchange Index (NYSE) and for Nasdaq. The NYSE had 1002 advances and 2264 declines, with 224 new highs and 35 new lows. There were 1546 advances and 3559 declines on the Nasdaq, with 308 new highs and 167 new lows.

Nasdaq and New York in 2023 breadth figures with more new highs than lows for the week. However, on Friday, the Nasdaq had the lowest volume over the last several weeks and more new lows than new highs, which could be a one-day wonder or a warning the rally of a consolidating period or correction has started. Time will tell.

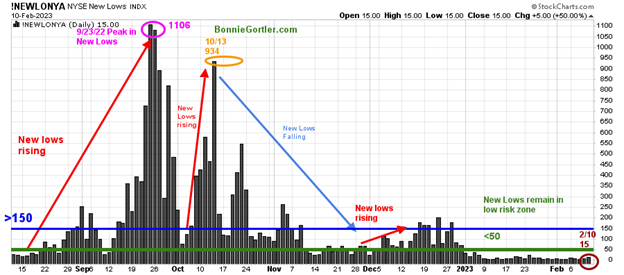

Figure 4: Daily New York Stock Exchange (NYSE) New Lows

Source: Stockcharts.com

Watching new lows on the New York Stock Exchange is a simple technical tool that helps awareness of the immediate trend's direction.

New lows warned of a potential sharp pullback, high volatility, and "panic selling" for most of 2022, closing above 150. The peak reading was 9/23/22 when new lows made a new high of 11/06 (pink circle).

Despite the decline, new lows closed on 2/10 at 15 (brown circle), below 25, remaining in the lowest risk zone and short-term positive for the market. On the other hand, a rise above 150 and an expansion of new lows would be a warning of weakness forthcoming. Learn more about the significance of new lows in my book, Journey to Wealth, published on Amazon. If you would like a preview, get a free chapter by emailing me.

NYSE breadth weakened but remained in an uptrend

Figure 5: Daily New York Stock Exchange (NYSE) Cumulative Advance-Decline Line

Source: Stockcharts.com

The above chart is the cumulative Advance-Decline Line (AD Line) of the NYSE, a breadth indicator based on the number of advancing stocks minus the number of declining stocks. It's positive the 2022 downtrend has been broken, with the AD-Line making a higher high, confirming the NYSE's high. Last week both the AD line and NYSE down ticked. However, it is positive that the October uptrends for both remain in effect. It’s too early to say the 2023 rally is over.

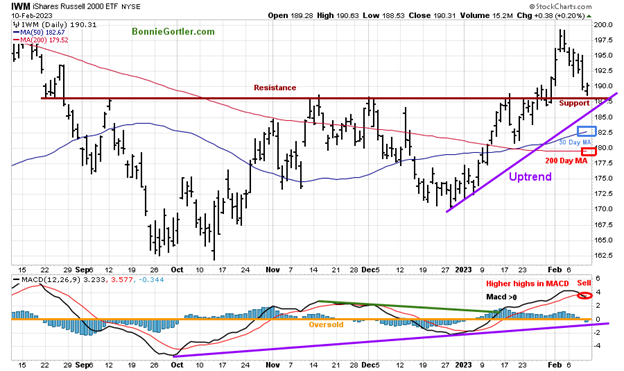

Figure 6: Daily iShares Russell 2000 (IWM) Price (Top) and 12-26-9 MACD Bottom)

Source: Stockcharts.com

The top chart is the daily iShares Russell 2000 Index ETF (IWM), the benchmark for small-cap stocks, with a 50-Day Moving Average (MA) (blue line) and 200-Day Moving Average (MA) (red line) that traders watch and use to define trends. IWM closed at 190.31, down -3.39%, remaining above its 200-Day MA (red rectangle) and 50-Day MA (blue rectangle). Although IWM was weak last week, it closed near its highs on Friday, which is a positive sign the decline was only a retracement of the breakout.

MACD generated a sell, above zero (orange line), but remains in an uptrend for 2023 after making a higher high, a sign of underlying strength. Support is at 187.50 and 182.50, and 180.00. Resistance is at 195.00, 199.00, and 205.00. With the IWM December uptrend confirmed by a higher high in MACD despite the sale, another rally attempt is likely.

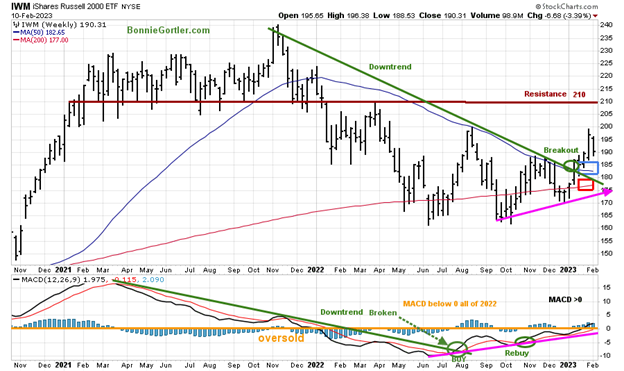

Figure 7: Weekly iShares Russell 2000 (IWM) Price (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

It’s bullish the weekly iShares Russell 2000 Index ETF (IWM) confirmed the daily breakout breaking the weekly downtrend from October 2022 and is above its 50 and 200 Week Moving Averages.

MACD, (a measure of momentum) remains on a buy, above zero for the first time since 2022, implying underlying strength. The intermediate trend remains up.

Learn about coaching with Bonnie. Ask questions. Discover more about the coaching processes in this 15-minute call by emailing me at Bonnie@BonnieGortler.com. I would love to schedule a call and connect with you.

Figure 8: Daily Invesco QQQ Trust (QQQ) Price (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The chart shows the daily Invesco QQQ (QQQ), an exchange-traded fund based on the Nasdaq 100 Index. QQQ moved lower after a false break out (purple circle) in September of the August downtrend (green line) but had a few rally attempts after but stalled and made a low in October 2022 (red circle). A successful retest occurred in early January 2023 and has improved considerably in 2023 after breaking the downtrend (purple line) and hitting a new six-month high in February.

QQQ was under some selling pressure, down -2.12% last week, retracing part of its recent gains closing at 299.70 after QQQ could not get through resistance at 314.00 and reversed lower. The decline appears to be a normal pullback after the considerable gains in 2023, closing above the 50-Day Moving Average and the 200-Day Moving Average (red rectangle).

QQQ support is at 295.00, 291.00, and 287.00; the old resistance area (brown dotted line) is acting as support. Resistance is at 305.00 and 314.00, with an upside objective of 331.00. The bottom chart is MACD (12, 26, 9) remains on a buy, falling, above zero, close to generating a sell. However, with the strength of the rise in QQQ, MACD at the highest reading since August, and the intermediate trend favorable, the odds favor the first sell to be premature and another rally to follow.

The intermediate trend for QQQ is favorable despite weakness last week

Figure 9: Weekly Invesco QQQ Trust (QQQ) Price (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The top chart shows the weekly Invesco QQQ Trust (QQQ). QQQ peaked in November 2021 (red circles) but failed to make a new high in December 2021. QQQ then formed two downtrends (brown line and green line). One downtrend (brown line) was broken back in August. However, QQQ immediately turned down (pink circle), making a lower low in October (purple arrow), followed by a rally in November and a successful test of the low before 2023’s big upside move began.

MACD in the lower chart made a higher low, as QQQ made a lower low, a positive divergence. MACD continues to rise after breaking the January downtrend (brown dotted line) and appears ready to break the September 2021 downtrend (green line), a sign of underlying strength. With the intermediate uptrend remaining in effect, QQQ will likely move higher before a significant correction.

Figure 10: Daily Van Eck Vectors Semiconductor (SMH) Top, 12-26-9 MACD (Middle) and Money Flow (Bottom)

Source: Stockcharts.com

The top part of the chart shows the Van Eck Vectors Semiconductor (SMH) concentrated, mainly in US-based Mega-Cap Semiconductors companies. SMH is a lead indicator for the market when investors are willing to take on increased risk and the opposite when the market is falling. Semiconductors (SMH) fell only -1.98% last week, closing at 244.01, a leading sector, up +20.24% in 2023. SMH broke its steep 2023 uptrend but remained in the longer-term uptrend since October (green line) and above its 50 and 200-Day Moving averages (blue and red rectangle). SMH support is at 240.00, 235.00, and 230.00, followed by 214.00. Resistance is at 250.00 and 255.00.

MACD (middle chart) generated a daily sell, showing weakening momentum after its massive gains. Money Flow (bottom chart) peaked (red rectangle) and turned down from an overbought level, trending down, not yet oversold. With the intermediate uptrend in SMH remaining intact and SMH stronger than QQQ based on relative strength, the MACD sell signal may be premature.

SMH remains stronger than QQQ based on relative strength for the intermediate trend.

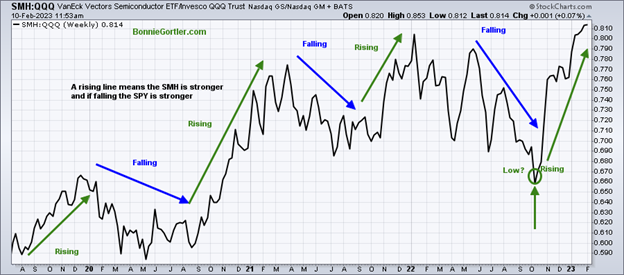

Figure 11: Semiconductors (SMH)/Invesco QQQ Trust/ Ratio (SMH/QQQ) Weekly

Source: Stockcharts.com

The top part of the chart is the weekly Semiconductors (SMH) Invesco QQQ Trust Relative Strength Index Ratio (SMH/QQQ). A rising line means the SMH is more robust; if falling, the QQQ is stronger.

Notice with last week's decline; the SMH remains stronger than QQQ. No change in relative strength has occurred yet. Many times, before a correction occurs, the SMH will be a clue that there will be a decline because it will fall faster than the QQQ and lead the market lower. Keep an eye out next week if SMH continues to outperform the QQQ, which is positive, or on the other hand, if SMH underperforms the QQQ, which would be considered short-term negative.

The SMH intermediate trend is up

Figure 12: Weekly Van Eck Vectors Semiconductor (SMH) Top, 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The top chart is the Weekly Semiconductors (SMH) ETF, which broke its downtrend in October 2022 and retraced the breakout in late December, testing the low with a pattern of higher lows and higher highs. Its bullish SMH remains in the longer-term uptrend since October (purple line) and above its 50 and 200 Week Moving averages (blue and red rectangle), showing underlying strength. MACD, the lower chart remains on a buy, above zero, a sign of positive momentum.

Figure 13: The S&P 500 Index (SPY) Daily (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The S&P 500 (SPY) made a six-month high in early February. Last week the SPY closed at 408.04, just below support at 409.00 (brown line), but two uptrends remain in effect, an uptrend from October 2022 and January 2023, along with the intermediate trend. It’s not wise to guess the top or bottom. SPY closed above the 50-and 200-Day Moving Average (blue and red rectangle), showing underlying strength. MACD (lower chart) shows weakening momentum but no negative divergence. I do not recommend going short with the uptrends intact and the intermediate trend favorable.

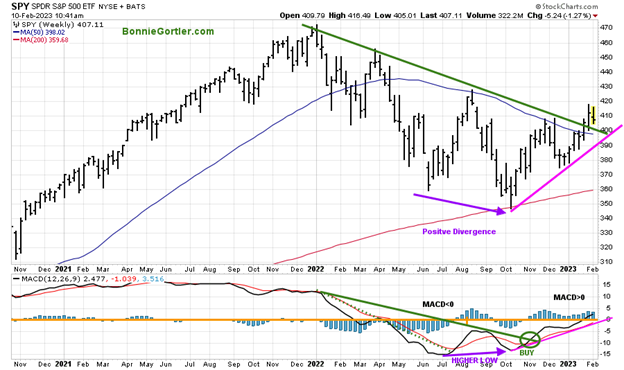

Figure 14: The S&P 500 Index (SPY) Weekly (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The top chart shows the weekly S&P 500 Index (SPY) breaking the weekly downtrend (green line), shifting the intermediate trend to up. MACD (lower chart) remains on a buy (green circle), broke the 2022 downtrend in November 2021, and continues to rise, reaching zero, implying a sign of strength. SPY has an upside target of 440.00 and potentially higher if support at 400.00 holds.

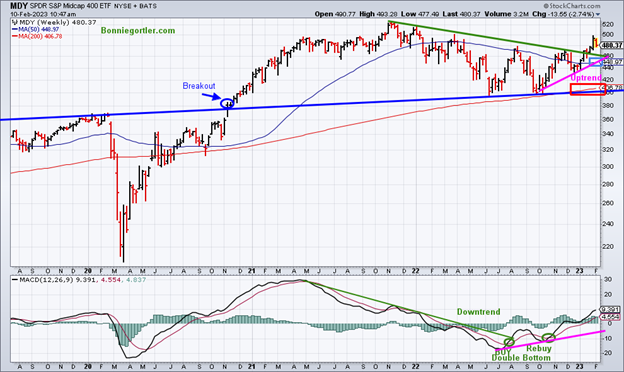

Figure 15: SPDR S&P Midcap 400 (MDY) Weekly (Top) and 12-26-9 MACD (Bottom)

Source: Stockcharts.com

The top chart shows the SPDR S&P Midcap 400 (MDY) weekly chart in an uptrend since making a low in October 2022 (green line). MACD (lower chart) remains on a buy (green circle) and continues to rise, reaching zero, implying a sign of strength. As long as the uptrend remains intact, MDY will likely work its way higher toward the November 2021 highs.

US Dollar remains above the November 2022 downtrend

Figure 16: US Dollar Daily

Source: Stockcharts.com

The US dollar peaked in September 2022 and trended lower into early 2023. The dollar closed up +0.76% for the week, and on Friday, 02/10/23, the dollar closed near its high for the day and highest close in three weeks. The USD remains above the November daily downtrend (brown line) but below the September 2022 downtrend (green line).

The downside objective remains at 98.80 (lower pink dotted line), but a close above 104.00 would negate the downside objective. If the dollar continues to rise, look for a further pullback in international markets. On the other hand, if the rise in the dollar falters, then global equities will likely work their way higher.

Summing Up:

The S&P 500 and Nasdaq declined after reading their highest level in six months to start 2023. Nasdaq broke its five-week winning streak as profit-taking in stocks began, and investors were unwilling to take risks and somewhat cautious. Market breadth weakened but remains favorable. February is off to a rocky start but appears to be only a short-term pullback and not the beginning of a significant correction, with the Nasdaq, Semiconductors, S&P 500, and Russell 2000 remaining in an intermediate uptrend based on price and momentum. Higher prices are likely before a significant correction occurs.

Remember to manage your risk, and your wealth will grow.

Let’s talk investing. You can set up your Free 30-minute Wealth and Well-Being Strategy session by clicking here or emailing me at Bonnie@BonnieGortler.com. I would love to schedule a call and connect with you.

Disclaimer: Although the information is made with a sincere effort for accuracy, it is not guaranteed that the information provided is a statement of fact. Nor can we guarantee the results of following any of the recommendations made herein. Readers are encouraged to meet with their advisors to consider the suitability of investments for their particular situations and to determine their risk levels. Past performance does not guarantee any future results.