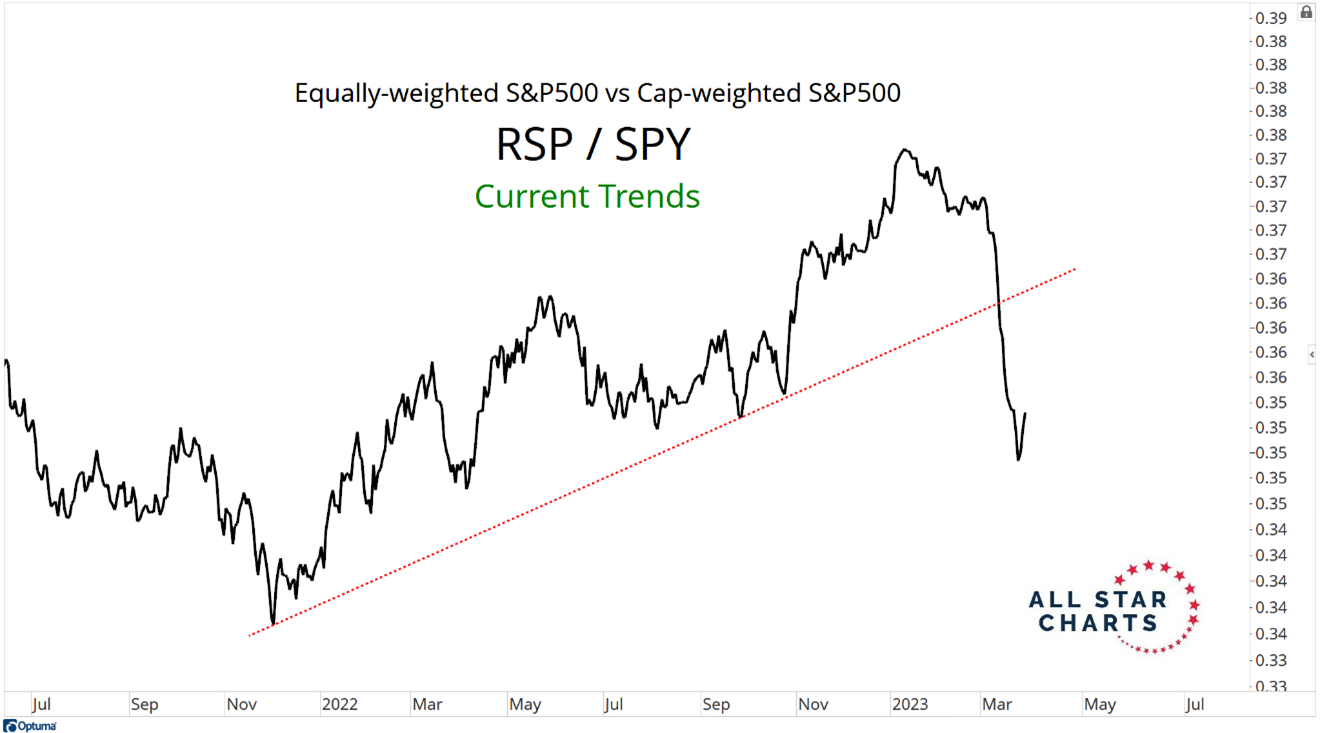

You're seeing the permabears pointing to the equally weighted S&P 500 (RSP) falling towards new 52-week lows relative to the Market-cap weighted version, states JC Parets of AllStarCharts.com.

You can see what's happening here:

But just because the larger market-cap stocks are outperforming your "average" stock doesn't mean it's not a bull market. When you look back at history, it just means that larger-cap stocks are getting inflows faster than others down the cap scale. That's all.

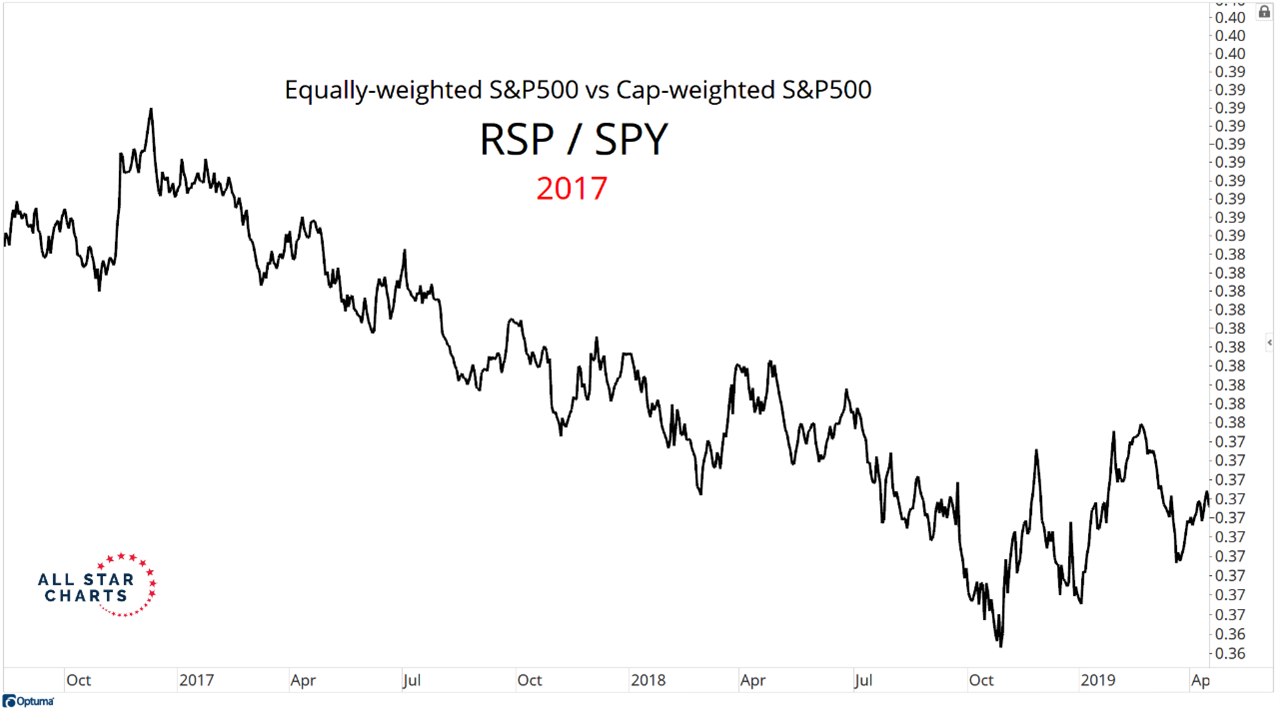

A good example of this was seen in 2017. Remember how angry they all were after Trump was elected? "Go to cash", they said. Well, as soon as Trump was elected President the stock market went on to have one of its greatest and least volatile years in American history. The equally weighted index underperformed that whole time...

And to be clear, 2017 wasn't a record year 'because' of Donald Trump. That was just the catalyst at the time to skew market sentiment way too negative. The "recession" that never seems to come and the bank "crisis" that the journalists keep telling me about appear to be this cycle's version of Trump.

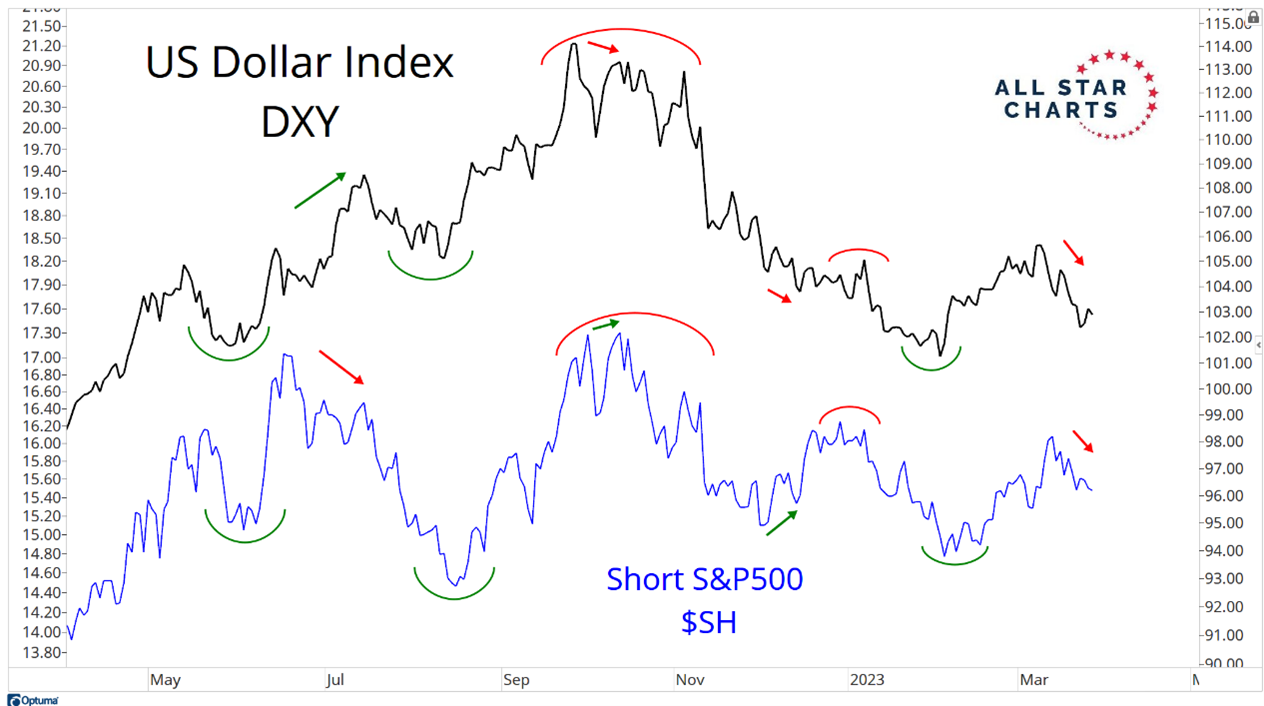

The bottom line is this: It's not about whether the equally weighted version of the S&P 500 is outperforming or if it's the cap-weighted S&P 500 (SPY) version leading. It's still about the Dollar. A weaker Dollar is consistent with higher stock prices. A stronger Dollar will likely put pressure on stocks. Here's the US Dollar Index (DXY) with the Short S&P 500 ETF overlaid below it.

Notice how they look the same:

When Dollars are falling, so is the Short S&P 500 ETF. In other words, a weaker Dollar leads to higher stock prices, and vice versa. The direction of interest rates is determining which types of stocks will outperform.

The direction of the Dollar determines whether stocks will go up or not. That's how I see it. Because I'm data-driven.

To learn more about JC Parets, please visit AllStarCharts.com.