Covered call writing is a low-risk cash-flow strategy that can also create the potential of a second income stream when using out-of-the-money (OTM) strikes which can also produce potential income from share appreciation, states Alan Ellman of The Blue Collar Investor.

When incorporating underlying securities that offer dividend distributions, we now have a strategy with three income potential sources: option premium, share appreciation, and dividend distribution.

Strategy Analysis

- Purchase top-performing blue chip stocks

- Re-evaluate bullish assumption monthly (or weekly)

- Capture quarterly corporate dividends

- Sell out-of-the-money covered calls

- Call premium

- Share appreciation potential

- Three potential income streams per stock

Stock Selection (BCI Blue Chip Report as an Example)

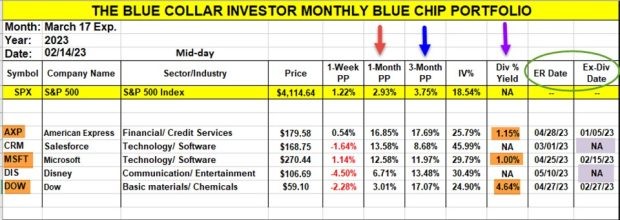

Blue Chip (DOW 30) Report for March 2023 Contracts

- The red and blue arrows show these securities outperforming the S&P 500 over the past one- and three-month time-frames

- The purple arrow shows the dividend annual yield

- The green circle shows key dates to avoid, earnings, and ex-dividend dates

30-day initial time-value returns with upside potential when using OTM call strikes

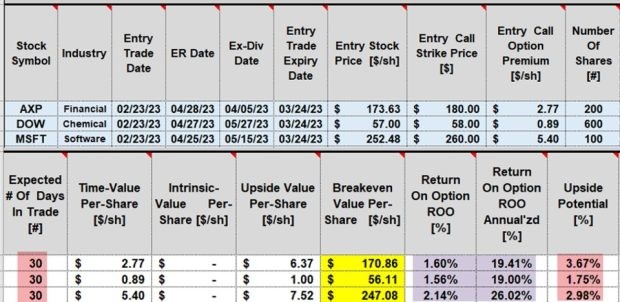

Initial Calculations Using the BCI Trade Management Calculator

- The initial time value 30-day returns range from 1.56% to 2.14%

- Annualized returns range from 19.00% to 26.02%

- Upside share appreciation potential ranges from 1.75% to 3.67%

- These calculations do not include the dividend yield aspect of this three-income strategy

Dates to Avoid

- Earnings reports: Okay to own the stock through the report and write the call after the report passes

- Ex-dividend dates: Do not have an option in place that expires after the ex-date. Ex-dates are the most common reason for early exercise

- Use weekly options (when available) to circumnavigate around earnings and ex-dividend dates

Discussion

Covered call writing using OTM strikes on dividend-bearing stocks is a reasonable approach to developing portfolios with a three-income stream per trade potential. This article featured using the best-performing Dow 30 stocks with OTM monthly call strikes, one of many ways to structure such portfolios.

Learn more about Alan Ellman on the Blue Collar Investor Website.