The black stuff is on a tear following announcements from Russia and Saudia Arabia that they would continue to limit output for the remainder of 2023, states Ian Murphy of MurphyTrading.com.

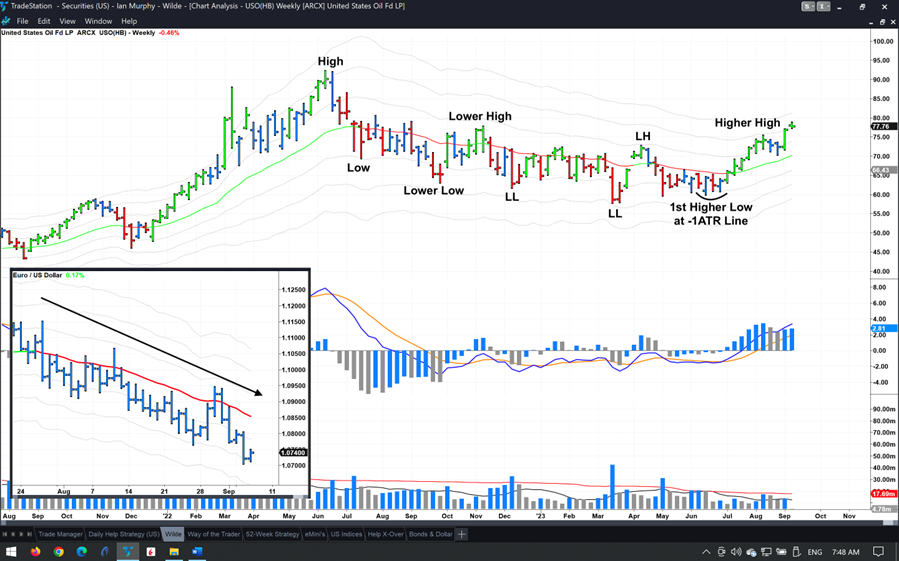

The US Oil Fund ETF (USO) found support at the -1ATR line on a weekly chart in mid-June (9 times out of 10 that’s where it happens) and the trend changed from lower lows and highs to higher lows and highs began in earnest (the oil futures chart look the same). The price is now within spitting distance of $80, a level not seen in over 14 months.

Because oil is priced in US dollars, and the greenback has also been on a roll (inset chart) it looks as if the winter season will be costly in the non-US northern hemisphere. If holding a weekly trend-following position in this ETF, the exit trigger will be the same as any other stock or ETF, continue to stay long until the price is about to close below the -1ATR line on a Friday afternoon. Currently, the exit is $66.43.

Learn more about Ian Murphy at MurphyTrading.com.