Covered call writing is not a zero-sum strategy. Both the option-seller (call writer … us) and the call buyer can be successful, states Alan Ellman of The Blue Collar Investor.

This article will provide a hypothetical example, demonstrating a scenario where both call buyer and seller end up with substantial one-month returns.

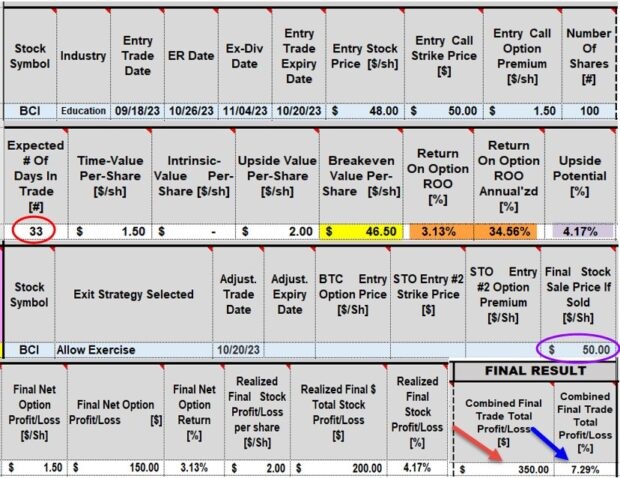

Hypothetical covered call writing trade

- 9/18/2023: Buy 100 x BCI at $48.00

- 9/18/2023: STO 1 x 10/20/2023 $50.00 call at $1.50

- 10/20/2023: BCI trading at $52.00 on expiration Friday

- 10/20/2023: Take no action and allow the exercise of the $50.00 call, selling shares for $50.00.

Calculations with the BCI Trade Management Calculator (TMC)

- The top row shows the initial trade entries.

- The 2nd row shows the trade to last 33 days if taken through contract expiration (red circle).

- The breakeven price point is $46.50 (yellow cell).

- The 2nd row shows an initial return of 3.13%, 34.56% annualized, based on a 33-day trade (brown cells)

- The 2nd row shows an upside potential of 4.17% if BCI moves up to, or beyond the $50.00 call strike (purple cell)

- The 3rd row shows that the option was allowed to be exercised and shares sold at the $50.00 agreed-upon sale (strike) price (purple circle)

- The 4th row shows a final cash return of $350.00 (red arrow) or 7.29% (blue arrow) for the 33-day trade.

Covered call trade from the option buyer’s perspective

- 9/18/2023: one contract of the BCI 20/20/2023 $50.00 call purchased at $1.50 per share or $150.00 for the one contract

- 10/20/2023: With BCI trading at $52.00 at expiration, the $50.00 call option is valued at $2.00 of intrinsic-value + minimal time value, let’s say $0.02 for a total sale value of $2.02 per share, $202.00 per-contract

- Based on an investment of $150.00, the final result is a return of 135% for the 33-day trade

Discussion

Covered call writing is a strategy where both the call seller and buyer can be successful. Of course, there is a risk from both perspectives, and not all trades will turn out as favorable as this hypothetical, but many do.

Learn more about Alan Ellman on the Blue Collar Investor Website.