It's really something fascinating to witness. Both retail investors and the professionals are scared in the middle of a bull market, excalims JC Parets, founder of AllStarCharts.

We just saw the largest net inflows into money market funds since April of 2020, which was right at the beginning of the greatest 52-week period for stocks in American history. It felt like the world was coming to an end in April of 2020. Remember? Well earlier this month, money was flowing into the "safe" haven of money market funds at the fastest pace since then. The S&P500 is less than 1% from new all-time highs. The German DAX keeps closing at new all-time highs. Sector rotation continues to be the lifeblood of this bull market, as the new low lists can't seem to expand at all.

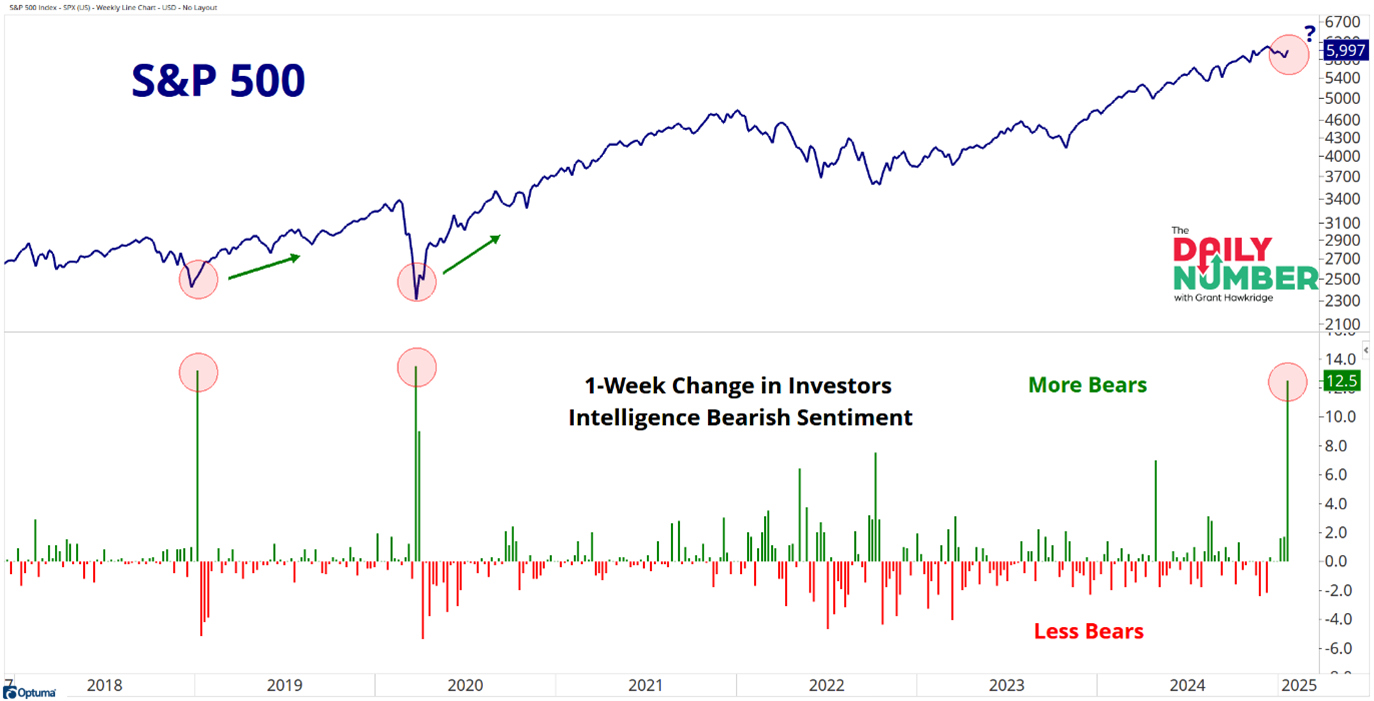

Do you know why the new lows list can't seem to expand? Because too many stocks are going up in price, rather than going down. It's just math. Meanwhile, instead of just buying stocks during a bull market, which has been proven historically to be a profitable strategy, newsletter writers are recommending their readers do the exact the opposite. In fact, we just saw the biggest 1-week spike in bearish sentiment among newsletter writers since Covid. These spikes in bears are historically a great buying opportunities. And I see no evidence that this time will be any different:

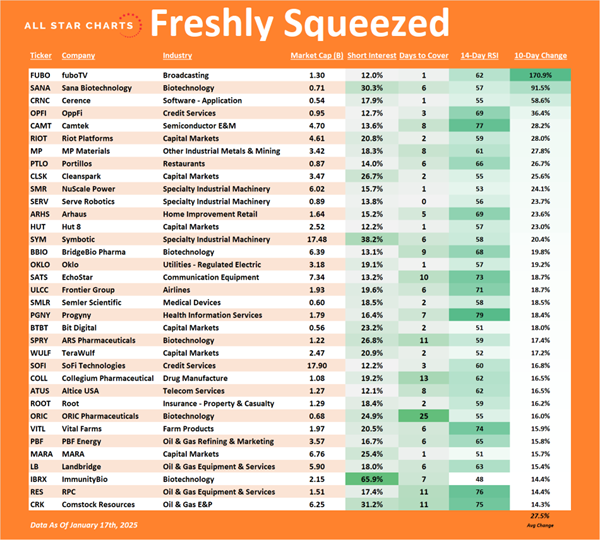

This chart above comes from Grant's Daily Number, one of my favorite emails I get each morning. So let's review. Stocks are in a bull market and investors are embarrassingly pessimistic. What's the best way to take advantage of that? KICK THEM WHEN THEY'RE DOWN! As I like to remind people, they say that you shouldn't kick someone when they're down. But the truth is, that's actually the best time to kick them…when they're already down. So we developed our Freshly Squeezed List that identifies the most vulnerable participants, so we can kick them after they're already falling down.

Here's the thing. Just because a stock has a high short interest, and just because it's got a high number of days to cover, doesn't mean the stock price is going to squeeze higher. That's why we sort the list by short-term momentum, so we can focus on kicking the ones that are already down on the ground getting beat up. Life is easier that way.

Here's the latest:

The first thing we want to do is identify the type of market environment we're in. AND THEN, we decide which tools and strategies are best for that type of market environment. It's a process. It doesn't have to be a complicated process. But it does have to be consistent. And that's what we do around here.

Subscribe to AllStarCharts here...