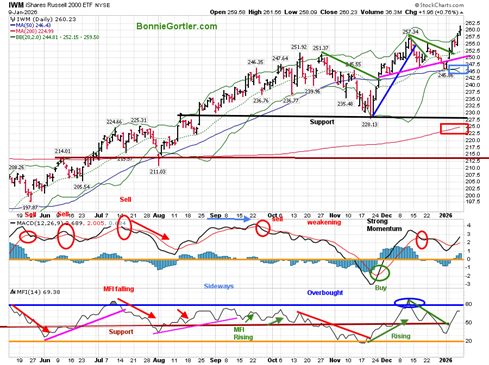

The iShares Russell 2000 ETF (IWM) led the market higher last week, gaining 4.6% to close at 260.23, well above the 50-day moving average. If small caps continue to show leadership, it's likely to fuel a broader market advance, advises Bonnie Gortler, CEO of BonnieGortler.com.

All major averages were higher last week, too. Market breadth turned up. Semiconductors also led, which is positive for the broad market.

iShares Russell 2000 ETF (IWM)

New Lows closed Friday at 21, in the very low-risk zone where prices tend to rise. It will remain positive in the short term if new lows stay between 25 and 50. On the other hand, if new lows begin to rise and exceed 150, it would be short-term negative with more volatility and increased risk.

Market breadth improved last week after weakness the previous week. The NYSE Common Stock Index made a new high. You want to continue to see breadth remain positive.

All in all, it would be bullish if the S&P 500, the S&P Mid Cap, and the S&P Small Cap Advance-Decline lines make new highs.