Despite all the recent volatility and the heavy selling in precious metals last week, market breadth was only slightly negative on the Nasdaq and NYSE. Stock market volatility is likely to continue, but support levels remain intact on the major averages, observes Bonnie Gortler, CEO of BonnieGortler.com.

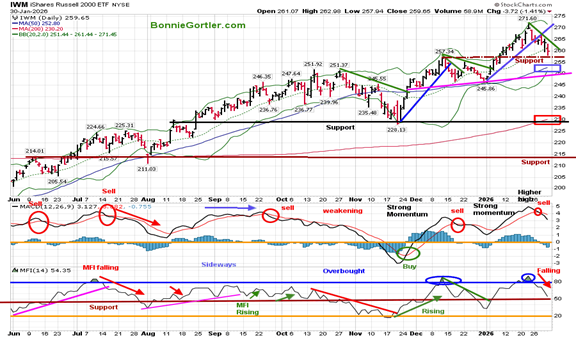

The iShares Russell 2000 ETF (IWM) just fell four days in a row, losing 1.9% last week and retracing toward its December 2025 high. But it held support (brown dotted line), and it closed above its 50-day Moving Average (blue rectangle), both of which are signs of strength.

iShares Russell 2000 ETF (IWM)

Source: StockCharts.com

The MACD (middle chart) is on a sell signal. However, momentum confirmed the IWM price high, suggesting another rally is likely. It may not exceed the momentum high, though, which would then make IWM more vulnerable to a meaningful pullback.

Meanwhile, the Invesco QQQ Trust (QQQ) fell only 0.1% last week despite the volatility. QQQ looked poised to break out to the upside, yet there was no follow-through, as investors digested earnings announcements from Big Tech.

Invesco QQQ Trust (QQQ)

Source: StockCharts.com

Momentum (MACD) and Money Flow (MFI) are both falling, but staying in a range. Two closes below 599 would be short-term negative. On the other hand, two closes above 627 would be short-term positive.