January was a month of rotation: Tech and financials lagged while energy, materials, and staples outperformed. Meanwhile, Palantir Technologies Inc. (PLTR) just jumped after sales and profit came in above expectations and the tech defense contractor forecasted 61% topline growth for the year, highlights Amber Kanwar, host of the In the Money with Amber Kanwar podcast.

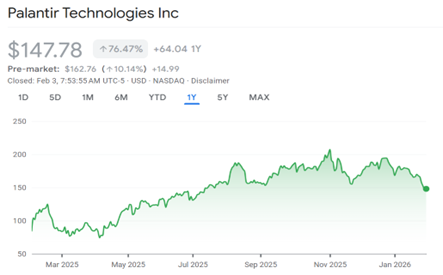

In January, small caps beat large. But Palantir’s results restored faith in its prospects. The stock had been under pressure going into earnings, down nearly 30% from its November peak.

Palantir is a lightning rod both as a stock and as a company. The stock trades at a demanding 135x earnings. The company is engaged with the US government, deploying a tech stack that makes it easier to hit targets on missions. It also has contracts with US Immigration and Customs Enforcement (ICE), which enables the agency to collect information on individuals.

CEO Alex Karp, who doesn't shrink away from controversy, said the sales growth was a “cosmic reward” for shareholders. Have you noticed the way some executives talk about AI is the same way people talk about religion?

Citi’s Tyler Radke wrote: “Q4 was another extraordinary print…Palantir’s momentum increasingly stands out in a software market where accelerating growth stories are rare." He's a buyer here even though his own price target implies the stock should trade at 62x sales ($250/share price target).