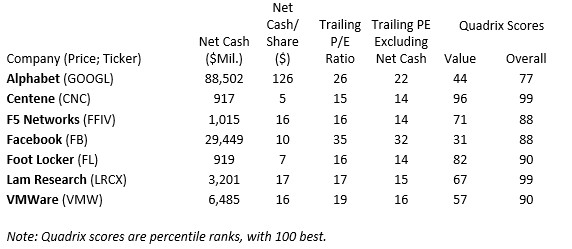

Here, we take a slightly different spin on the popular valuation metric, price/earnings ratio, explains Richard Moroney, editor of Dow Theory Forecasts.

By backing out net cash from the stock price used in the P/E ratio’s numerator, we reward companies with well-capitalized balance sheets and penalize companies swamped with debt.

For example, Alphabet’s trailing P/E of 26 becomes a more reasonable 22 after backing out net cash of $118 per share. The following recommended stocks have lower trailing P/E ratios once we exclude cash net of debt.