Trump 2.0 is officially underway...and markets are already moving in response. Currencies like the Mexican peso and Canadian dollar are slipping thanks to tariff threats. Bitcoin briefly hit a record high above $109,000 on expectations of looser regulation. And stocks are broadly stronger amid hopes for higher corporate profits.

But what about ENERGY? How will underlying commodities – and energy sector equities – trade in a new Trump Administration? On the one hand, “Drill, baby, drill” policy means more companies can explore for and produce more oil and natural gas in more locations. On the other hand, more production means more supply, which likely means lower prices.

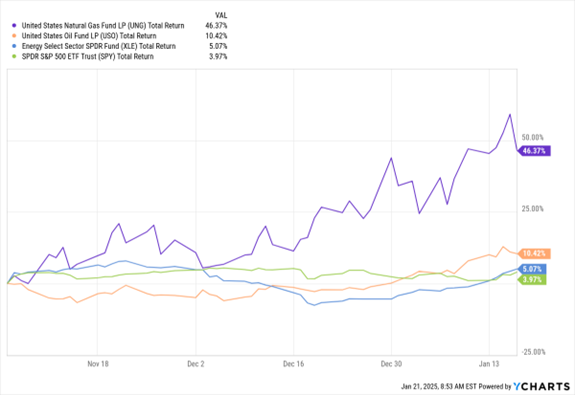

Let’s go to the MoneyShow Chart of the Week for some clarity. It shows the performance of two ETFs that track natural gas and crude oil futures prices, the United States Natural Gas Fund (UNG) and the United States Oil Fund (USO). It also shows the percentage change in the Energy Select Sector SPDR Fund (XLE) and the SPDR S&P 500 ETF (SPY) from Election Day through the present.

Data by YCharts

You can see that the energy sector has slightly outperformed the S&P 500 during the post-election period. Meanwhile, crude oil has risen around 10%, while nat gas has surged more than 46%.

What does that tell us?

For one thing, shorter-term, weather-related forces are overwhelming longer-term policy-related ones. Much colder weather across the US and in other Northern Hemisphere countries is driving heating demand higher, and that is pushing up nat gas and oil prices. For another thing, policy takes time to implement. Easing regulations now won’t lead to an immediate boost in US production.

Another thing to keep in mind: Energy companies, lenders, and investors got crushed in the shale oil bust of the mid-2010s. Then they got socked again when oil prices went NEGATIVE in 2020 during the pandemic. As a result, they’re likely to act in a more disciplined fashion the next couple of years – returning money to shareholders via dividends and buybacks rather than plowing every last dollar into boosting production.

Bottom line: Energy markets and energy stocks are signaling (SO FAR) that conditions remain favorable...and that “drill, baby, drill” policy won’t be the profit-killing problem some were worried about. Invest accordingly!