These are the times that try Big Tech investors’ souls. The Magnificent Seven stocks – and a handful of other tech names – have led the markets for the last few years. But several are cratering in the wake of news out of China.

You’ve probably seen the news, but just in case: A Chinese firm called DeepSeek released details on its Artificial Intelligence (AI) model. The short version? It compares favorably to US models...at just a fraction of the cost. That is leading investors to question the sustainability of AI-related tech spending, and to dump shares of Mag 7 stocks like Nvidia Corp. (NVDA) and Mag 7-adjacent names like ASML Holding NV (ASML) and Broadcom Inc. (AVGO).

So, how much of a concern is this for markets? Here are THREE MoneyShow Charts of the Week I’ll share...and my ONE take on what to expect next.

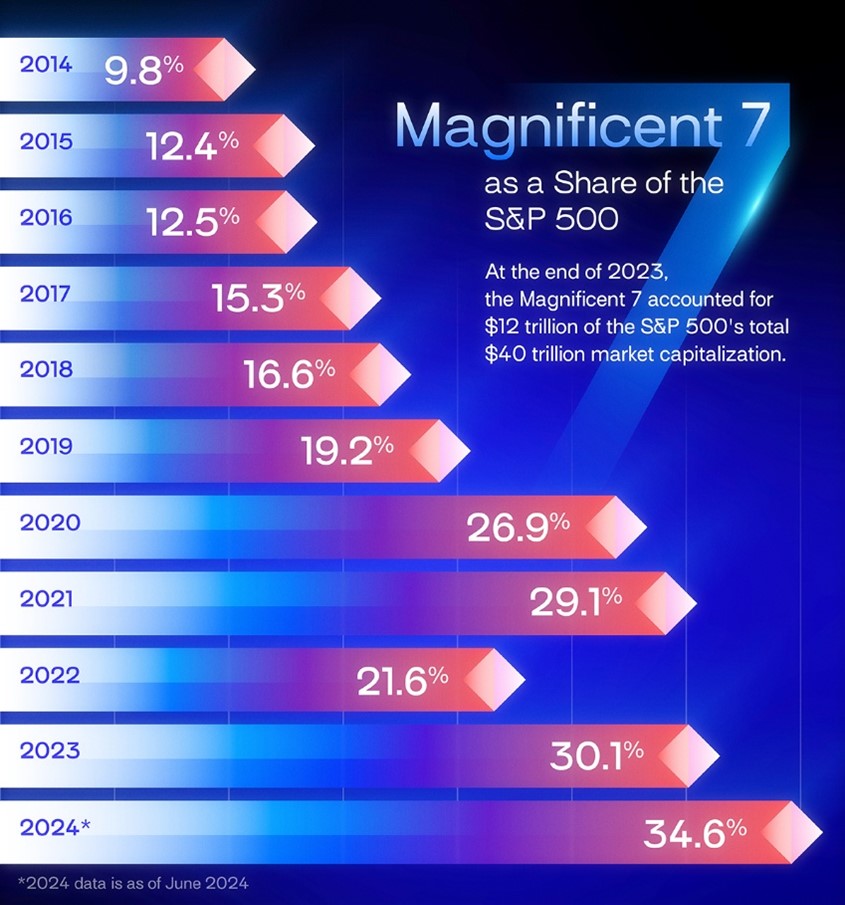

Let’s start with this graphic from Visual Capitalist. If you think the Mag 7 dominate the S&P 500 index...you’re right. And that dominance has only grown in the last few years. As of mid-2024, the Mag 7 stocks made up about 35% of the benchmark US index.

Source: Visual Capitalist

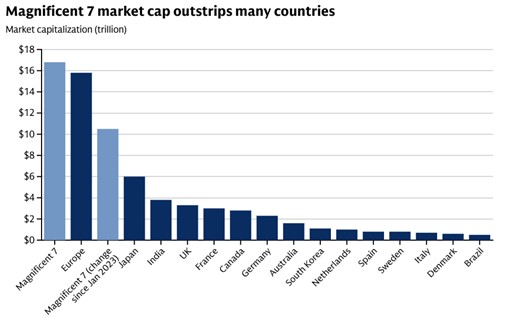

Separate research from Goldman Sachs here puts the Mag 7 in a global context. You can see that the seven stocks in the group have a greater market capitalization than all of the stocks in Europe. Compared with other leading developed-market or emerging-market nations like Japan, India, Canada, and Brazil, it’s not even close.

Source: Goldman Sachs Research, 1/23/25

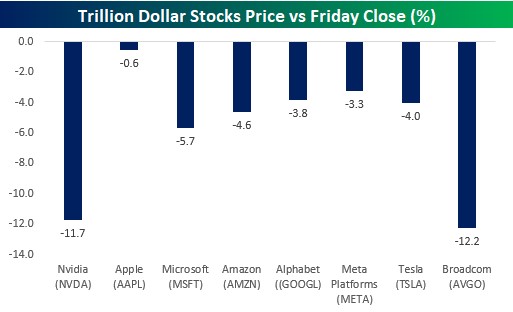

Now let’s get to the short-term action. Here’s a chart from Bespoke Investment Group showing how much the Mag 7 and Mag 7-adjacent stocks were losing in early trading today. These aren’t tiny declines. For names like NVDA and AVGO in particular, they’re MASSIVE drops for a single day.

Source: Bespoke Investment Group

So, what does it all mean for the future?

First, it underscores my thesis that you’re likely to see OTHER leaders pick up the market baton and run with it in 2025. The rotation toward new groups like small caps and new sectors like financials and industrials started last July...is fueled by a few different (and durable) forces...and should be a key theme this year.

Second, it doesn’t have to mean the end of the bull market. The Nasdaq could lag for a while. The S&P could take on some water given its top-heavy nature.

But as several of my MoneyShow MoneyMasters Podcast guests have pointed out, the “other 493” have a lot of things going for them, too. You can find attractive buys in groups outside of tech, including beaten-down value stocks that are likely to see capital rotate toward them.

So, resist the urge to sell everything here. Instead, use the news as a “Wake Up Call” to put more money to work in OTHER names!