BONDS, PRECIOUS METALS, STOCKS, TECHNICAL

Jim Welsh

Macro and Technical Strategist,

Macro Tides

Follow

About Jim

As a 40-year veteran, Jim Welsh provides expert monetary analysis and is one of the few strategists that have the experience, knowledge, and combination of skills to help you navigate the coming secular bear market in equities. The cornerstone of his tactical strategy is the intersection of economic fundamentals, monetary, and technical analysis. Mr. Welsh covers stocks, treasury bonds, dollar, and precious metals.

Jim's Articles

As discussed in the Weekly Technical Review in recent weeks, iShares 20+ Year Treasury Bond ETF (TLT) was approaching the end of a five-wave decline from its peak in March 2020 at 179.70, states Jim Welsh of MacroTides.com.

Jim Welsh of Macro Tides sits down with Blake Morrow to discuss the markets after the end-of-month and end-of-quarter flows dominated this week.

As I discussed weeks ago, the rally since bond prices reached a bottom in October is likely Wave Four (red) from the high in March 2020, states Jim Welsh of MacroTides.com.

Two weeks ago the Consumer Price Index (CPI) and Producer Price Index (PPI) indicated that inflation picked up in January, after the CPI rose 0.5% and the PPI increased 0.7%, states Jim Welsh of MacroTides.com.

Jim's Videos

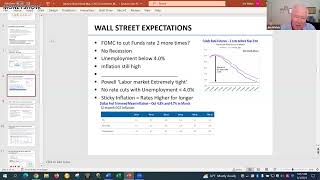

Last year a recession was widely expected after GDP contracted in the first and second quarters. Investors were wrong. He didn’t think there would be a recession in 2022 as discussed with Money Show attendees. Most investors now think a recession will be avoided since GDP has been positive in the first three quarters of 2023. Will investors be fooled again?

Many economists thought a recession had started in 2022 after GDP contracted in the first two quarters. When a recession didn't appear, economists said a recession would hit in the first half of 2023. For almost a year economists have been crying out Recession! Recession! Investors now think economists are just trying to fool them again and have decided worrying about a recession is a waste of time. What investors are overlooking is the decline in Gross Domestic Income in the fourth quarter and first quarter and the big drop in hours worked. The economy is set to slow markedly in the second half of 2023 and investors may not be positioned properly.

After two consecutive (Q1, Q2) negative GDP reports and the FOMC increasing the Funds rate by 0.75% in June and July 2022, many strategists believed a "Hard Landing" recession had already begun or would by year-end. Jim Welsh wrote there wouldn't be a recession in 2022. Now, after two consecutive quarters of positive GDP (Q3, Q4) and strong data at the beginning of 2023, many strategists believe there won't be a recession and are calling it a 'No Landing'. If a recession materializes after mid-year, the question is: Are markets positioned for a recession?

Investors have been trained to expect the FOMC to ease monetary policy at the first sign of economic weakness. In 2023, the FOMC won't pivot immediately as the economy slips towards recession. This will create a window of vulnerability for stocks and create a buying opportunity.