As part of our ongoing series of articles on bank stability, and at the request of many of our clients at Saferbankingresearch.com, we wanted to address the major risks we foresee for bank stability in the coming years. I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, cautions Avi Gilburt, Founder of EllitottWaveTrader.net.

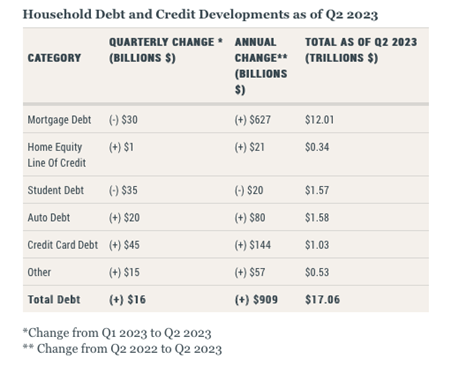

According to the latest household debt report, published by the Federal Reserve Bank of New York, credit card balances in the US rose by 16.2% YoY in 2Q23 and reached $1.03T. Moreover, credit card balances have seen seven quarters of YoY growth.

As the table here shows, credit cards saw the largest QoQ increase in absolute terms across all the types of retail lending.

Another interesting observation from the NY Fed’s report is that there are 70MM more credit card accounts open now than there were in 2019. Furthermore, about 69% of Americans had a credit card in Q223, up from 65% in December 2019 and 59% in December 2013.

The most important thing here is that such a massive increase in credit card portfolios occurred in a rising rate environment. As the Fed notes, the average rate on credit cards surpassed 22% in May. It was less than 17% before the pandemic.

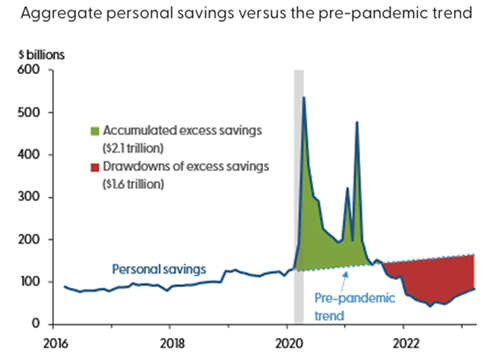

We believe that the pandemic-related savings are fading, but consumers want to continue spending more than they are earning. As a result, we see massive growth rates in credit cards. Here's the chart from the Federal Reserve Bank of San Francisco that confirms our assumption.

Despite significant risks, banks continue to approve those 22%-rate credit cards, as they need to somehow supplement their margins on the back of rising funding costs. Yet charge-off rates and delinquency rates are going up given increasing consumer stress.

Some counter that they’re just “normalizing,” as they were low during the pandemic. However, the pre-pandemic operating environment for banks was completely different from what we have now. Rates are higher nowadays, while the labor market is very favorable for consumers. Obviously, even a mild slowdown in the labor market is very likely to have a significant negative impact on charge-offs and delinquency rates for credit cards.

Car loans and a resumption of student loans’ repayments are other issues. If a major recession comes, there will be not only a large slump in car prices, particularly in used cars, but also a big increase in unemployment as well. Federal student loans started accruing interest again on Sept. 1, and payments will be due starting in October.

The bottom line? The current rise in consumer lending will likely place greater pressure on the already weak banking system in the coming years. This is just one of the many issues we have identified. At the end of the day, we're speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.