It’s no secret that a popular sector to watch as the holiday season approaches is retail. And even in the midst of a pandemic, there are a few noteworthy names that look to be defying the odds, notes Bernie Schaeffer, option expert and editor of Schaeffer's Investment Research Chart of the Week.

In fact, not only are these retail moguls making a plethora of recovery noise, but Nike (NKE), Lululemon Athletica (LULU), and Under Armour (UAA), are all hitting praise-worthy market-cap achievements. Even further, all three look like attractive buys for bull traders in the coming weeks of the tumultuous holiday season.

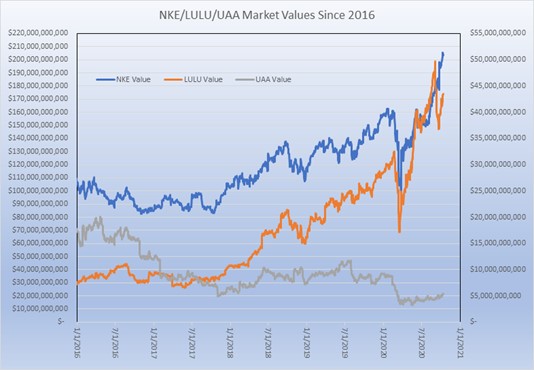

As we head into shopping season, it’s interesting to note that NKE’s market cap recently surpassed $200-billion dollars. Meanwhile, LULU had probed $50 billion before a recent rejection, while UAA is back above the $5-billion mark.

In the chart below, data from Schaeffer’s Senior Market Strategist Chris Prybal shows from 2016, Nike’s measurement range on the left hand side of the scale, and Lululemon and Under Armour’s on the right hand side of the scale.

Most interesting is that Nike looks to have found support at the $100-billion market cap level during the recent Covid-19 crush, allowing its charge up the charts to continue.

On the other hand, Lululemon Athletica’s rejection at the $50-billion mark brought a brief technical respite, though the stock is now making its way through a clear path higher.

Lastly, Under Armour has struggled the most in terms of outright value, but similar to Lululemon, is well on its way higher, with notable value landmarks less out of reach with each passing day.

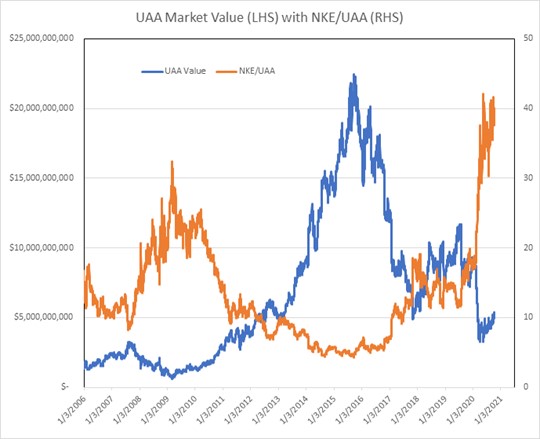

Something else of interest is the aforementioned drastic differentiation between shoe and clothing retailer Nike, and athleticwear leader Under Armour. Widening the scope, Prybal shared a look at the two from 2006.

The largest differentiation worth mentioning is that in recent weeks, Nike’s valuation peaked at 40 times that of Under Armour’s. But again, the steep pullback in Under Armour’s value seems to have been short-lived, with the equity continuing its recovery in a consistent fashion, no pun intended.

Diving into a more specific technical setup, we are taking a closer look at NKE, LULU, and UAA’s Schaeffer's Volatility Index (SVI) rating. The SVI is the average at-the-money (ATM) implied volatility of a stock's front-month options.

The indicator is helpful to determine whether short-term options are currently pricing in high or low volatility expectations, relative to the past year's worth of data.

The higher the SVI percentile, the higher short-term volatility expectations are at the moment. Thus, options traders should ideally target stocks with low SVI percentile rankings, because this means near-term options are pricing in relatively low volatility expectations.

In this instance, all three retail giants are boasting attractive options, with LULU, NKE, and UAA boasting SVI’s of 41%, 29%, and 75%, of which, rank in the low 19th, 13th, and 36th percentile of their respective annual ranges.

In turn, this boasts an attractive buying opportunity for all three securities — a welcome reprieve and encouragement amid the chaos of a pandemic stock market.

Subscribe to Schaeffer's Investment Research's Chart of the Week here…